Like many people in the UK, I invest via Trading 212. It is a relatively recently-formed company and, as I am entrusting them with my investments, I pay close attention to their financial position. They have recently published their accounts for 2023, so I thought I would dig into the numbers to see what they can tell me about the financial strength of my broker.

Trading 212 Corporate Structure and History

Trading 212 Group Ltd is registered in the UK, company number 10014283. It was set up in 2016 and is the holding company for the wholly-owned subsidiaries Trading 212 UK Ltd, Trading 212 Ltd (registered in Bulgaria), and Trading 212 Markets Ltd (registered in Cyprus).

Trading 212 Ltd is the company which develops and maintains the Trading 212 investing platform / app, Trading 212 UK Ltd (Companies House company number 8590005) supports UK-based customers and is regulated by the Financial Conduct Authority in the UK (FCA firm reference 609146), while Trading 212 Markets Ltd was set up for European investors following Brexit and loss of passporting privileges. Trading 212 Markets Ltd is regulated by the Cyprus Securities and Exchange Commission. At the time of incorporation, around 14% of Trading 212 accounts were transferred to the Cyprus subsidiary.

There are more companies in the group, but these three are the only ones currently trading and contributing to the Group’s financial position. There is a company in the Group known as Trading 212 Europe GmbH, still showing in the Group 2022 accounts, but this was in the process of being closed at the end of 2021. The Group also indirectly owns a company called Avus Supercars GmbH, registered in Munich, as that company is wholly owned by Trading 212 Ltd. Up until 2022, the Group also had an equity stake in a company called EnduroSat AD, a Bulgarian aerospace company making satellites for commercial and scientific purposes.

Trading 212 began life as a company called Avus Capital. In September 2017, Avus Capital UK Ltd became Trading 212 UK Ltd and Avus Capital Group Ltd became Trading 212 Group Ltd. Even as Avus Capital, the company used the investing platform known as Trading212, developed within the Group.

Principally, the company now known as Trading 212 provides brokerage services, originally focussing on internet-based Contracts for Difference (CFD) trading services, with a heavy crypto-currency presence. Over 95% of clients are retail investors / traders.

For the rest of this article, I will be referring to Trading 212 UK Ltd, unless I make explicit reference to the Group. Trading 212 UK Ltd services all UK, ex-EU and rest of world clients (therefore including me!) and the UK subsidiary has grown from 44% of Group revenues in 2020 to almost 86% of Group revenues in 2022. The Cyprus subsidiary accounted for almost 4% of Group revenues in 2022, while the Bulgaria subsidiary has fallen from 56% of Group revenues in 2020 to just over 10% of Group revenues in 2022, as the other subsidiaries (particularly the UK subsidiary) have grown so markedly. It is worth pointing out that, although UK revenues have grown over 80% between 2020 and 2022, Bulgaria revenues have dropped 83% and overall Group revenues have dropped 7% in that timeframe.

In 2016 / 2017, Bitcoin had its first surge in price, and T212 did well. However, the regulatory framework was changing, with regulators (both the Financial Conduct Authority in the UK and the European Securities and Markets Authority, ESMA) starting to pay more attention to cryptocurrency and, in particular, leveraged trading, posing a direct regulatory risk to the main source of T212’s revenue. Even in 2017, T212’s board was cautious about the exuberance being displayed in the crypto trading market and didn’t expect it to be sustainable. They were also concerned about the number of active, funded accounts on their books decreasing. At about this time, the company introduced physical equities as a product, and were looking for further diversification away from crypto-currency.

In 2018, ESMA did introduce new restrictions on leverage for retail clients, and over 2018 - 2019, T212 determined to pivot from CFD and towards stockbroking, building out the commission-free share-trading side of the business, supported by profits from the CFD arm. In their 2019 Strategic Report, the Board discussed a medium-term objective to move to a subscription-based or freemium business model, and move away from transaction-based revenue in order to provide more stable cash flows.

For the curious investor…. in the FCA website, you can look up the names of the key people involved with the firm (including a number of directors) and see whether they have been approved by the regulator or certified by the firm, and whether there have been any disciplinary or regulatory action taken against them. You can also see where the firm has passporting rights (in this case, to Gibraltar) and what services it is regulated to offer.

References: Companies House link, FCA link

The Board

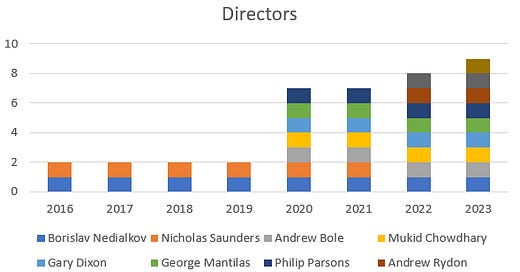

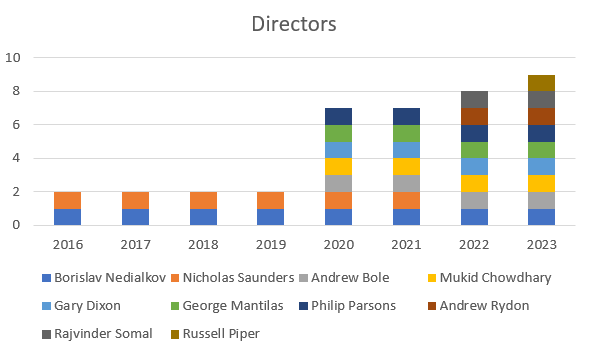

There has been one director with the company since 2016 through to 2023 - Borislav Nedialkov (although he resigned in January 2023). In the early days (up until 2021), he was joined by Nick Saunders. They were the only two directors until 2019, but in 2020 and 2021 ( the period to prepare the 2020 accounts), the Board expanded significantly, up to a maximum of six people serving concurrently (7 people were named as directors in that year, but Nick Saunders had resigned before Mukid Chowdhury, George Mantilas or Philip Parsons were appointed). Except for Nick Saunders, the rest of the new board members were still named as Directors up to and including the 2023 accounts. In 2023, Boris and Philip Parsons resigned. Rajvinder Somal, appointed as a Director in 2022, also resigned in 2023. Andrew Rydon was appointed in 2022 and Russell Piper was appointed in 2023, both of whom were still with the company at the time of the 2023 accounts publication.

The make-up of the Board of Directors as named in each year’s accounts is laid out below:

I am curious around how the board will look going forwards and whether there will be any major changes to the company’s direction without any founding members still being Directors, but then, all companies need to develop succession plans.

Revenue and Profit

Given the pivot from cryptocurrency trading towards commission-free stockbroking, in 2019 T212 undertook a promotion to grow the number of stockbroking accounts. After a significant dip in revenues in 2019, there was huge growth in 2020, with further prodigious growth in 2021. Revenues have been relatively stable in 2022 and 2023, with a slight decline between 2022 and 2023.

In November 2017, an issue with the platform and its price feed led to an inability for certain trades to complete, which exposed Trading 212 UK Ltd to claims from users for compensation. In turn, T212 UK Ltd was able to claim compensation from T212 Ltd, with an overall small impact on income (around 0.5% of revenues from brokerage services).

Operating expenses (OpEx) have increased every year since 2020, increasing ten-fold from 2019 to 2020, and then typically increasing 40% - 50% per year between 2020 and 2021 and between 2022 and 2023.

Breaking down OpEx by category, it is clear that 2020 and 2021 saw very high bank fees, while more recent years have seen fairly considerable intercompany support expenses and much higher advertising and marketing expenses. I have excluded Research and Development (R&D) expenses from this breakdown, although 2023 saw a £7.4M R&D expense which also provided £2M of R&D tax credits recorded in ‘other income’. Foreign exchange (FX) expenses also provided a slight benefit over the period 2020 - 2022 inclusively.

Despite the significant increase in OpEx in 2020, operating margins increased until 2021 and remained above 50% until 2022, but margins were significantly impacted in 2023. Nonetheless, an operating margin of close to 30% is still good.

An important finance expense incurred in 2023, and likely to be incurred in future years, is the interest value provided to clients. Trading 212 makes a substantial amount of money on the deposits lodged with the brokerage, particularly in 2022 and 2023. While it is a very positive step (and keeps T212 on the right side of the FCA probe launched in July 2023), I estimate it reduced T212’s net profit margin by about ~ 2.5 percentage points (250 basis points) after tax. Although arguably some of the associated finance income and expenses are related to their operations, T212 break them out as financing activities, separate from their core operations, so I have done similarly.

The effective tax rate has increased from 18% in 2016 to 21% in 2023.

Some important changes took place in 2021. Trading 212 originally operated on a “matched principal” basis for Contracts for Difference (CFDs) and on an agency basis for equity trades. This meant that T212 engaged in back-to-back hedging with an affiliate, which limited T212’s financial risk exposure to only FX movements. In May 2021, the company decided to manage its own financial risk on CFDs in the market, meaning it now has increased market risk exposure (but potentially less cost for hedging). After August 2021, T212 operated as a systematic internaliser, meaning the company is no longer just an agent for trades, and holds inventory on its balance sheet (which I believe is represented under the category “current asset investments” in the financial reports).

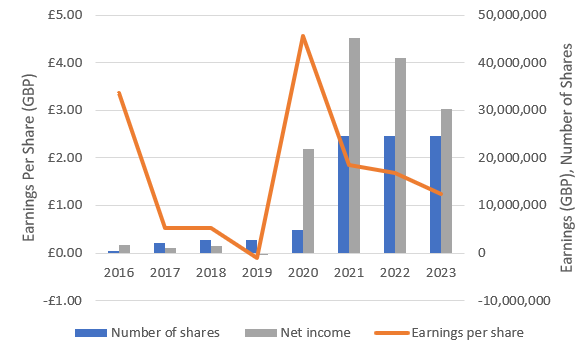

Earnings Per Share and Share Capital

T212 has significantly increased the level of share capital in recent years, in each case, the newly issued shares being bought by Trading 212 Group at par value of £1 per share, which has directly positively contributed to financing cash flows. Therefore, although absolute profits increased substantially from 2020 to 2021, earnings per share fell, and have been falling somewhat each year since, as net profit margins have come under pressure. However, the company is still comfortably profitable.

The Balance Sheet

As required by the FCA, money deposited with T212 by clients is classed as ‘segregated client funds’, meaning it is held in segregated accounts holding statutory trust status. This limits T212’s ability to control the money, so they are not included on T212’s balance sheet. An exception is money considered to be “prudently segregated”, which is recorded as Receivables. Prudent segregation is described in the CASS Best Practice Guide as the situation when the company pays its own money into a client account to provide provision for specific risks. Such risks must be specifically documented in accordance with CASS regulations (Cass is the FCA’s Client Assets Sourcebook).

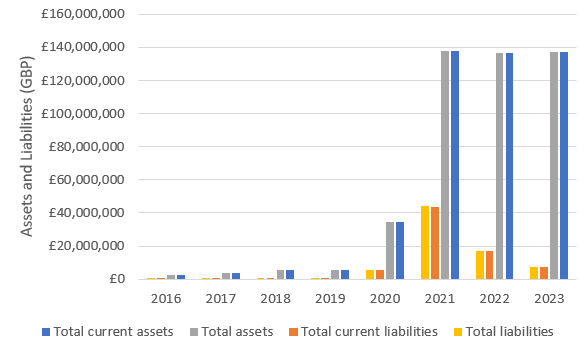

Returning to the balance sheet, more evidence of the rapid increase in company size over 2020 and 2021 is clear from T212’s cash and equivalents, which jumped in 2021.

Assets and Liabilities are dominated by current assets and current liabilities. In the case of assets, the main categories are cash & equivalents, trade receivables and current asset investments. The liabilities are more evenly split across a number of categories, with changes between largest categories year to year. Most recently the major liabilities have been trade payables, payables owed to the Group, taxation and social security, and provisions. The Notes to the Accounts reveal that there is a particular activity being undertaken with HMRC which is not currently being disclosed to avoid prejudice (aligned with IAS 37), accounting for over half of the current provision. The majority of the other half of the provision is linked to client claims for redress and activities with the Financial Ombudsman. The notes state that T212 has already rejected a number of claims, but while claims are ongoing, provision is recorded for prudence.

2021 had a significant amount of liabilities (relative to 2020 and 2022) - this is largely because the 2021 balance sheet carried £21M in liabilities for “amounts owed to brokers”. I don’t know if this is in relation to the aforementioned changes from an agency model to holding investments on its own balance sheet, but this liability was not explicitly present in prior years or in years since.

Converting the absolute numbers to financial metrics, it is clear that T212 has a strong balance sheet, with typical liquidity ratios very comfortably above unity, even in 2021.

Although not shown, a review of T212’s balance sheets shows no real debt to speak of, although there have been small levels of lease liabilities in the past and payables to the group have generally exceeded receivables owed by the group. The financial accounts do show interest expenses (excluding interest payments provided to clients), but interest cover has been greater than 73 times operating profit since 2016, so interest expenses are very small relative to profits.

Returns on Capital

T212 has had a couple of questionable years in terms of its Return on Invested Capital (ROIC), but generally its margins are very strong, with over 20% Returns on Assets (ROA) and Returns on Capital Employed (ROCE). Being a capital-light business with a high cash balance and low debt, in my opinion, returns on invested capital is much less relevant in the case of this company than in the case of the typical industrial companies I normally analyse. I want T212 to hold a large cash balance and have low debt! For a financial services company, to me, this is not indicative of capital not being ‘worked’, it is indicative of prudent asset management. Therefore, I am more interested in Return on Assets and Return on Capital Employed in this case.

To highlight how capital-light this business is, look at the Property, Plant and Equipment turns (the profit generated for every £1 of net PPE on the balance sheet). Generally, T212 is generating between £350 and £400 of profit for every £1 of PPE.

Cash Flows

Despite no loans being clearly defined on the balance sheet, there is financing from loans and loan repayments clearly described in the statements of cash flows. There have also been dividends paid to shareholders in 2022 and 2023. However, by and large, the company has been managing its cash flows well, with small net changes in cash most years.

2021 show a very, very large cash flow from operations, aligned with the very high net income that year, but also elevated by a net £22.6M improvement in working capital. Conversely, the net £5M use of cash from operations seen in 2023 is due to a net £24M increase in working capital.

2023 saw large changes in investing cash flows and financing cash flows relative to previous years. The investing cash flows were dominated by finance income received, which is orders of magnitude higher than in previous years (T212 relate finance income received to income as an adjustment to operating cash flow, moving it to financing cash flows, in keeping with not including financing cash flows in operating profit). Financing cash flows in 2023 are dominated by dividends and a net repayment of loans, broadly offsetting a net increase in debt financing seen in 2022. 2020 and 2021 financing cash flows would have been negative, except for the influx of new equity capital related to the issuance of new shares. This is the reason for the large positive financing cash flow in 2021.

Valuation

As a private company, T212 shares are not available to buy. But, just for fun, I thought it would be interesting to run a quick discounted cash flow valuation.

I calculate free cash flow (FCF) to be around 67p per share currently. Earnings per share (EPS) is around £1.24. Book value per share is around £5.30. Without being publicly listed, it is difficult to identify beta, weighted average cost of capital or price/earnings, but if I assume T212 would have similar valuations to Hargreaves Lansdown and AJ Bell, I would estimate a beta value of around 0.8 and a P/E of 15 - 20. This would lead to a cost of capital close to unity by my estimation and, with no debt to speak of, this is equivalent to a weighted cost of capital of around 0% (which is probably far too cheap!). A more typical cost of capital is around 10%.

By looking at EPS and FCF/share history, there has clearly been a lot of variation in recent years. If I assume EPS future annualised growth could be anything between a 10% reduction and a 20% increase (in keeping with ROA and ROCE), with a 10% weighted cost of capital, I would estimate an inherent value of around £23. For a valuation based on FCF, I think future growth could be anything between a 30% reduction and a 20% increase, which would yield an inherent value of around £13.

Therefore I would suggest a fair value for the share price would likely be in the range of £15 - £20, if T212 were publicly traded.

Conclusion

Trading 212 is a profitable company which has seen astronomical growth recently. I see no major warning signs which would cause me concerns if I was investing, with strong margins, although there is evidence of growth stalling and margins reducing of late - it will be interesting to see what happens with the prevailing interest rate environment over the coming years.

For now, I am happy to continue to use T212 as my broker.