Deeper Dive: Anglo American Value

What does the failed BHP takeover tell us about the intrinsic value of Anglo American?

At the end of May, BHP finally admitted defeat on their takeover play for Anglo American (AAL).

On 20 May, BHP had offered 0.886 shares for every share of Anglo American, pursuant to AAL divesting its platinum business and Kumba iron ore business. In BHP's view, this valued AAL at £31.11, based on the relevant closing prices at the time of the announcement, a 47% premium to the share price before the original merger announcement initially became public knowledge. A valuation of £31 is also in line with valuations I undertook based on FY2022 and 23H1 results, where I had ascribed an intrinsic value of approximately £30 to AAL.

So were BHP being generous, or taking advantage of a beaten-down stock?

What were BHP willing to pay for?

Anglo American owns the following assets:

Copper

Collahuasi in Chile, a project owned by AAL (44%), Glencore (44%), and Japan Collahuasi Resources BV (12%). Ore reserves are estimated to contain around 33 Mtonnes of copper at ~ 0.86% Cu grade on average. The mine is expected to have over 70 years of life left.

Los Bronces and El Soldado mines in Chile, each owned by AAL (50.1%), Mitsui (29.5%) and Mitsubishi Materials (20.4%). El Soldado is only expected to have around 5 years of reserves, but Los Bronces has over 30 years left, with ore reserves of over 7.7 Mtonnes of copper at ~ 0.5% Cu grade.

A 50.1% stake in the Chagres flash smelter in Chile

Quellaveco in Peru, owned by AAL (60%) and Mitsubishi Materials (40%). Similarly to Los Bronces, Quellaveco is expected to have over 8.2 Mtonnes of copper within its ore reserves at ~0.5% Cu grade, enough for around 35 years.

This means AAL has a claim to around 23 Mtonnes of copper, to be extracted over at least 30 years. In addition to the ore reserves, AAL has over 13 Mtonnes of measured and indicated copper mineral reserves, and a further 20 Mtonnes of mineral reserves inferred (not all of which may be feasible for development). This gives AAL the potential for up to 56 Mtonnes of copper. And whereas the average price realised for copper was around $3.84/lb in 2023, it is now close to all-time highs of $4.50/lb.

AAL's unit costs will change with source and grade, but from their 2023 report with unit costs of roughly $2/lb in Chile and $1/lb in Peru, AAL would have weighted unit costs of around $1.67/lb, leaving $2.82/lb profit at current prices, or a copper asset value of around $143 bn of ore reserves at current prices. Adding in the potential mineral reserves, this number could increase to $347 bn.

With 1.2 bn shares outstanding, $143 bn would translate to an asset value of $119/share, not allowing for inflation or increased operational costs as reserves deplete.

Assuming fairly constant production rates, 23 Mtonnes over 30 years is in the range of 750 ktonnes per year, close to 2024 guidance, which would be worth around $960M per year at current profit levels, or $0.80/share. Over 30 years at a discount factor of 10%, this would be worth in the region of $8.34/share at present value, or £6.43 at current GBP/USD exchange rates.

Mineral reserves could offer additional value, but they would be accessed and consumed at a later date (effectively beyond the 30 year timeframe assumed above), meaning the present value of those mineral reserves will be quite low and will be ignored here, making the above value a conservative estimate.

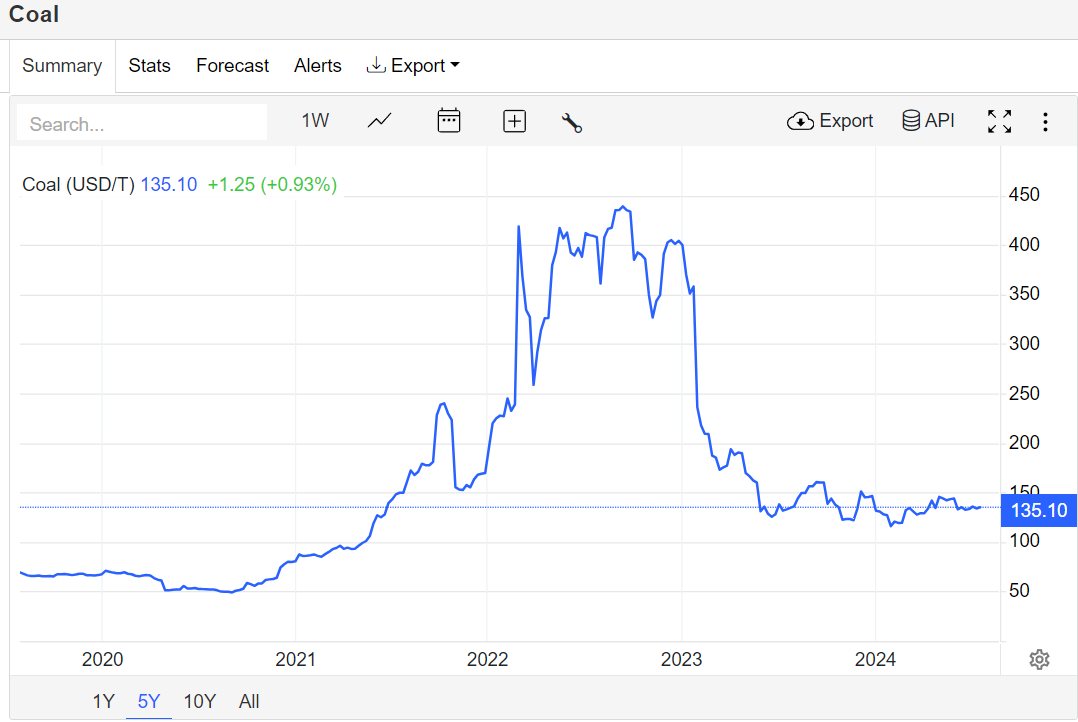

Coal

AAL's steelmaking coal business is from a number of assets in Australia, covering metallurgical coking coal, other metallurgical coal and thermal coal. AAL's ownership stakes vary from 51% to 88%, with around 320 Mtonnes attributed to AAL. Mine life varies from 6 years to 21 years, with a weighted life of around 16 years, implying annual production of almost 20 Mtonnes. This is higher than is currently being achieved, with 2024 guidance around 15 - 17 Mtonnes, but with a stated intent to work towards 20 Mtonnes per annum.

Coking coal is significantly more valuable than thermal coal, but in 2023, AAL achieved an average price of $261/tonne for a unit cost of $121/tonne, a profit of $140/tonne. 15 Mtonnes per year per 16 years would yield a present value of around $13 bn, or almost $11/share, or £8.58/share.

Although coal has pulled back a lot from its 2022 highs, it is still trading at a premium to historical averages, which could significantly influence the present value attributable to AAL's coal business.

Iron Ore - Minas Rio

AAL has two main iron ore assets - Kumba in South Africa, where AAL has a 52.5% ownership, mine life is around 13 - 14 years, the ore grade is 63% - 64% iron and the unit production cost is around $41/tonne; and Minas Rio in Brazil, 100% owned by AAL with a reserve life of over 50 years (I estimate nearer 70 years at current production levels) and a unit cost of $33/tonne with a slightly higher ore grade of 67% iron.

BHP only wanted the Minas-Rio operation, which I anticipate to have a present value of around $16.5 bn, or around £11/share, for a realised iron ore price of $110/tonne from Minas-Rio, or $114 on average across both operations.

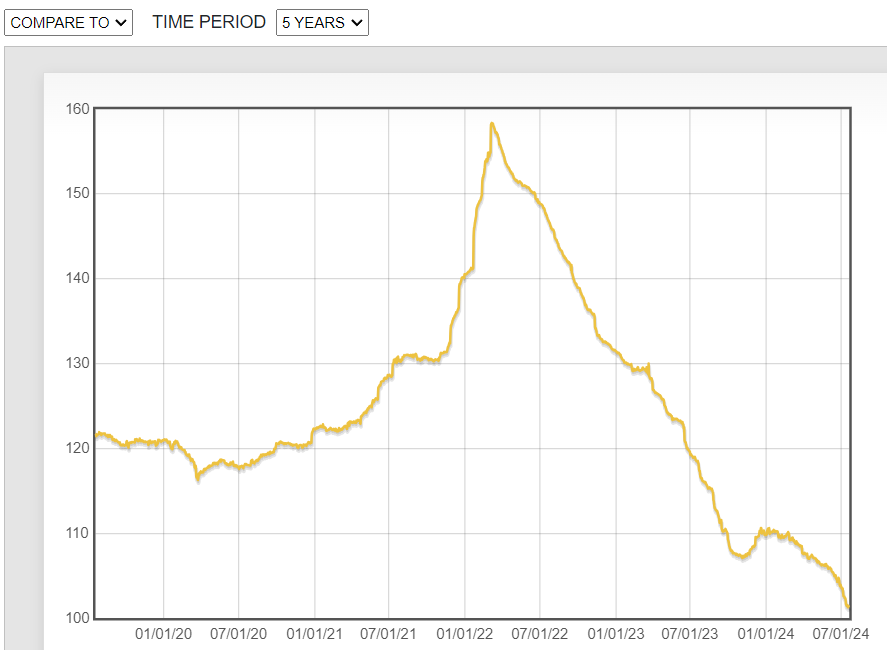

Diamonds

BHP included the De Beers operation within their offer, but were anticipating possibly selling the division.

Diamond prices have dropped precipitously recently, but were doing well in 2022. Over 2023 (while the price was dropping over the course of the year), AAL quoted a realised price of $147/ct, vs. a unit cost of $71/ct.

There are a lot of assets across South Africa, with Namibia and Botswana being some specific operations where there have been recent arrangements struck with governments around ownership and profit sharing. By my estimates, based on aggregated ownership, mine life and production volumes, De Beers is contributing almost £7/share to the current AAL share price.

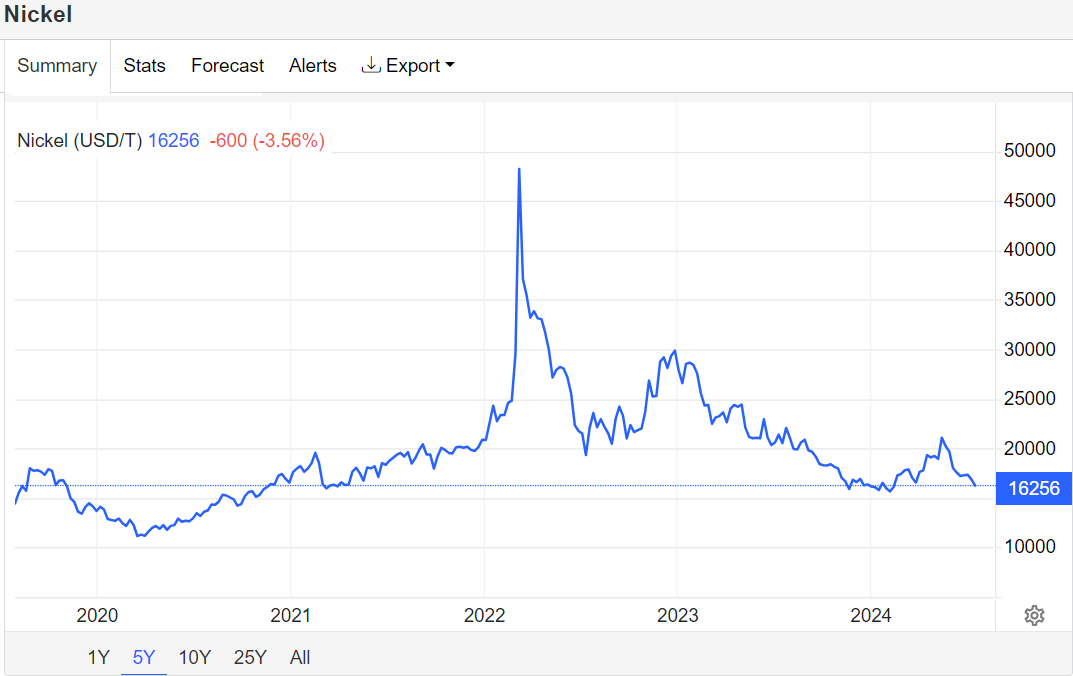

Nickel

Nickel has not done that well of late, but it remains a profitable asset for AAL. AAL’s ferronickel assets are based in Brazil, but it is a relatively small contribution to AAL’s bottom line, at $133M EBITDA in 2023, vs. a total EBITDA for AAL of almost $10 bn. However, it is still contributing around £0.71 to the AAL share price by my estimates, given 20 years of ore reserves at production of 40 kilotonnes per year, at a unit cost of $5.41/tonne and a realised price of $7.71/tonne.

What did BHP not want?

Platinum Group Metals (AngloPlat)

PGMs have dropped phenomenally in price recently, but that is in large part because of the highly elevated price of rhodium in the early 2020s, which has since subsided. Global PGM supply is predominantly mined in South Africa.

A major risk with PGMs is that the automotive industry is by far the largest end-use market, predominantly for use in the exhaust catalysts used with combustion engines. Battery-electric vehicles pose an existential risk to this set of minerals (there will always be some market, as hydrogen fuel cells still use PGMs, and there are some other industrial markets, but the size of these markets is only fractions of the size of the current automotive end-use market).

At current prices and current levels of production and ore reserves from AAL, I anticipate that AngloPlat (AAL’s PGM division) has a net present value of around £5.18/share. BHP’s assessment of the share price is in the same region as my assessment, with BHP attributing £5.40 to Anglo Platinum shares.

For anyone interested in digging into the applications for PGM in more detail, I highly recommend Johnson Matthey’s PGM Market Reports here.

Iron Ore - Kumba

As mentioned, although BHP were interested in AAL’s Minas-Rio iron ore asset in Brazil, they were not interested in the Kumba iron ore asset in South Africa.

By my estimates, the Kumba asset has current ore reserves for almost 14 years of production at 37 Mtonnes per annum. I expect the present value of these reserves to be almost $19 bn, vs. a little under $16.5 bn for the Minas-Rio asset. With 1.2 bn shares outstanding, I expect the Kumba present value to be around £15.81/share. By contrast, BHP estimated the value of Kumba at £4.23/share.

Valuations

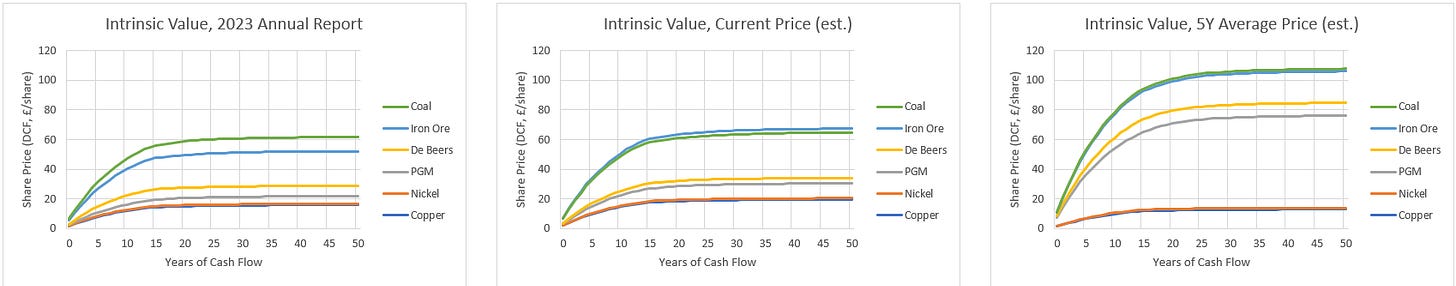

I have taken the realised prices for each asset, the ownership share of AAL in the asset (weighted by ore reserves where appropriate), the unit prices for each asset, the 2023 ore reserves and production or sales volumes to calculate the cumulative present value of each division, assuming a weighted average cost of capital of 10% (in my last valuation of AAL, I had calculated WACC to be between 8% and 12%).

In addition to the 2023 Annual Report realised price, I have also taken a current spot-price and an approximate 5-year average price for each commodity, based on the sources mentioned above , to try and estimate the present value of each set of assets in the current AAL portfolio, based on each of three price sources. The results are shown below.

In principle, after ~ 20 years, the contribution of future years to the present value is small. But the sum of AAL’s assets would, in theory, be worth around £60 at the current exchange rate of ~ £1.26 per USD. This is overly optimistic, as I am only considering the unit cost of production, and not the other costs that contribute to a segment’s true present value, such as exploration costs, administrative costs and any financing costs (unless such costs are already included in the unit cost quoted by AAL).

Predominantly, the largest contributions to AAL’s share price come from copper and iron ore, with current prices suggesting a maybe 50% premium to 5-year average prices for these commodities. De Beers (diamonds), by contrast, is currently running at a hefty discount to 5-year average prices. Coal is typically close to break-even on average, but provided a significant boost to AAL during 2023, while PGM price spikes in the last few years would have the potential to provide very large contributions to the share price if those prices were to be experienced again, and sustained, for a couple of decades (although this is obviously unlikely).

The BHP Offer - Present Value

Using the above approach, I have calculated the growth in present value for the assets BHP were interested in buying, vs. the remainder of the company.

If my valuations of AAL’s assets are close to correct, BHP were offering to pay for around 10 years of cash generation from the assets they want, based on historic average prices, but at current and more recent prices, they are effectively paying for only around 5 years of cash generation from AAL’s assets. Therefore, BHP stood to make a fairly significant future profit beyond that timeframe, at the expense of AAL’s current shareholders (remember that the effective price of £31.11 for BHP’s offer is equivalent to £21 for the assets BHP want to acquire, and realisation of the other £10/share would be from AAL’s divestment of the unwanted assets).

EBITDA → Present Value

There is a second method by which to approximate the value of BHP’s offer. For each segment, AAL provide 2023’s EBITDA and Capital Expenditure. EBITDA - CapEx is a very crude approximation to free cash flow, and therefore could be used to generate a present value over extended timeframes if both EBITDA and CapEx were constant into the future (which is highly unlikely to be the case), which may provide a better guide to future cash flow than purely realised price and unit production cost.

With this approach, the BHP offer seems more reasonable, suggesting a reasonable price compared to either current commodity prices or 5-year average prices, treating 2023 (and 2022, although not shown) as a bit of an anomaly.

However, all of these valuations assume only AAL’s current ore reserves are available. In fact, AAL’s 2023 Mineral report also show a significant amount of mineral reserves that are not included in the above valuations. Therefore, there is likely to be considerable additional cash generation beyond the numbers I have assumed herein. This would again make BHP’s offer appear to undervalue AAL’s assets.

Anglo's Future Plans

In response to BHP’s approach, AAL have proposed divesting their De Beers, coal, and PGM operations and putting their Nickel resources into “care and maintenance” (effectively mothballing these operations). AAL believe this will offer a more streamlined operation and accelerate value realisation.

I would estimate (based on 2023 realised prices and unit costs) this could value the remaining AAL assets at around £40/share, and lead to a return to shareholders of up to ~ £20/share through divestments. I’m not sure this full value would be realised via an asset sale, and there will be a lot resting on my assessment of the value of the Kumba resource, but I think it indicates there could be significant value to be unlocked, vs. AAL’s current share price.

The Bottom Line

You’d expect it to be the case, but the offer from BHP doesn’t appear to have been very generous, it looks to be either fair, or a pretty opportunistic bid with a short payback period.

In my opinion, AAL’s management were right to reject the offer as significantly under-valuing the company, but it is interesting that the Board now intend to follow a similar strategy of unlocking value by focussing on their copper and iron ore assets. Once they do that, AAL looks very much like RIO, in my opinion, but a bit more specialised and with less geographic diversity. This could very much influence my investment thesis.

Excellent write-up!