I thought I’d write a post about one of the industries in which I have high conviction. For disclosure, I own Deere (NYSE:DE) and AGCO (NYSE:AGCO), but I don’t own CNH Industries (NYSE:CNH). At the time of writing, DE 0.00%↑ is almost 10% of my individual stocks portfolio, and AGCO 0.00%↑ is a little under 5% of the same portfolio.

Why Agriculture?

Simply, I expect pressure on land use to keep growing. Between a growing global population to feed, increased biofuel use to support CO2 initiatives, increasing desertification in certain areas and increasing deforestation, I think companies supporting agriculture and farming efficiency will be a good future bet. They are, however, very cyclical - crops are commoditised and farm machinery is expensive, so farmers tend to invest in new machinery when commodity prices are high and farm income is good, and then hang on to their machinery and wait an extra year or two to replace equipment when farm income is not so good. Commodity prices are influenced to a large extent by supply and demand and weather, with unpredictably good or bad growing seasons.

Why these companies?

I believe these 3 companies cover the vast majority of brands that people may know. Deere are pretty much a household name, but even if people don’t know AGCO, they will likely know AGCO’s brands, like Massey Ferguson or Fendt. Similarly, CNH are the owners of Case and New Holland brands (hence the name), but also have a number of smaller brands, like Steyr and Miller. They all have global sales, but each company is relatively more or less popular in certain geographies or market segments. (N.B. Having worked for an engine manufacturer servicing the off-highway sector, I realise I may be more familiar than the average person with agricultural brands, so I use the term “popular” quite loosely here!)

All three of these companies are making moves into autonomy and technologically-driven farming. Farming is a particularly interesting use case for technology (“agritech”), as farmers have large areas of (privately-owned) land to cover, often with patchy (or non-existent) wi-fi coverage, and a large amount of operating profit to play for by improving the yield of crops, precise targeting of planting or spraying, etc. By using a subscription model, this secular trends also offers the opportunity for higher profit margins and reducing the cyclicality of the industry. I genuinely find this an interesting field of study (if you’ll excuse the pun!).

Whereas CNH 0.00%↑ and DE 0.00%↑ both have agriculture and construction segments, AGCO 0.00%↑ are a pure-play agriculture company.

Where do these companies make their money?

Total Revenues and Segment Breakdown

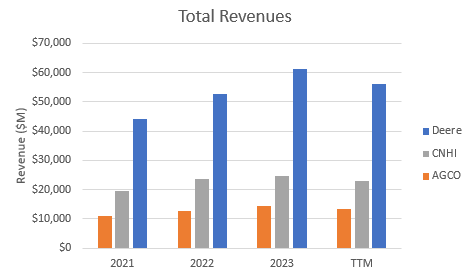

Deere are by far the largest company, generally selling more than twice as much as CNH, which is itself a quite a bit larger than AGCO.

Deere break their business down into the following segments:

Production and Precision Agriculture

Small Agriculture and Turf

Construction and Forestry

Financial Services

Geographically, Deere report their annual revenues in the following markets:

United States

Canada

Western Europe

Central Europe and CIS (CIS = Commonwealth of Independent States, essentially the former USSR)

Latin America

Asia, Africa, Oceania, and Middle East

CNH break their business down by:

Agriculture

Construction

Financial Services

and report revenues in the following geographical areas:

North America

South America

Europe, Middle East and Africa

Asia Pacific

AGCO segment their business geographically, reporting the following segments:

North America

South America

Europe and Middle East

Asia, Pacific and Africa

In addition, on an annual basis, AGCO break their revenues down by individual countries. This allows me to, using annual results, disaggregate some of these regions to estimate revenues in the following regions across all companies:

North America (United States + Canada)

South America (equivalent to Latin America)

Europe (including CIS)

‘Other’ (essentially Africa, Middle East, Asia and Pacific regions)*

*I am not able to isolate Middle East from CNH’s European segment sales, so I assume the Middle East sales are negligible compared to European sales for this segment for this company.

On a quarterly or trailing twelve month (TTM) basis, the geographic breakdown is typically not available, the exception being AGCO due to their use of geographical business segments.

To align segments when comparing these companies, I consider AGCO to be 100% Agriculture, I assume Deere’s Agriculture segment is the sum of their “Production and Precision Ag” and their “Small Ag and Turf” segments, and I assume Deere’s Construction and Forestry segment is similar to CNH’s Construction segment.

Geographical presence

As shown in Figure 1, Deere is the biggest company, but the vast majority of the difference in total revenues is to do with Deere’s presence in the Americas. In other global markets, Deere might be larger, but not by as much.

As a proportion of sales, it is clear that Deere is heavily biased towards North America, whereas AGCO have the greater European exposure, with CNH falling between the others. Deere is 60% North America and 10% - 15% Europe, whereas AGCO is around 50% Europe, and around 26% North America. All three companies have roughly 15% of their revenues coming from South America and 5% - 10% of revenues coming from ‘other’ regions (Africa, Middle East, Asia, Pacific and others).

Industry exposure

Agriculture is clearly the largest industry for each of these companies, being at least 60% of revenue. Deere also makes a fairly substantial amount of money (around 20% of revenue) from its Construction segment. Financial Services are around 10% of revenues for Deere and CNH, but are not segmented by AGCO (reading the notes to their accounts will highlight that AGCO does provide financing services via its joint ventures with Rabobank).

2021 - 2023 was a growth period for all of these companies, but as shown in Figure 1, the last twelve months have seen an overall softening, particularly in the agriculture industry. Interestingly, Financial Services have continued to grow, but they are not a large enough proportion of revenues for any company to offset the downturn in Agriculture and Construction segments.

Focusing on North America, South America and Europe regions, and recalling that geographic breakdown is typically only available in annual reports, it is obvious from Figure 6 that AGCO was growing strongly in Europe while CNH and Deere were fairly flat, and AGCO and Deere grew strongly in South America while CNH declined in 2023. In North America, all three companies grew strongly between 2021 and 2023, with CNH having stronger growth 2021 - 2022, and AGCO having stronger growth 2022 - 2023. However, Deere’s overall growth was strongest, with a 23% Compounded Annual Growth Rate (CAGR) between 2021 and 2023. AGCO and CNH each managed 19% - 20% CAGR over the same period.

Not apparent from Figure 6, is the softening of the market in 2024 now apparent from Figure 5. Although the geographic breakdown isn’t yet available for all companies, AGCO’s trailing twelve month results (not shown) show a roughly 10% drop in revenues since 2023 FY in North America, and a 20% drop in South America. This magnitude is consistent with the narrative being communicated by all companies via their recent earnings calls.

Operating Profits

So how good are each of these companies at converting these revenues into profit? This is a little difficult to compare, because each company reports its segment profits slightly differently - Deere reports Operating Profit, AGCO reports Operating Income and CNH reports Adjusted EBIT (Earnings Before Interest and Taxes). However, if we assume that these three metrics are comparable, then Figure 7 and Figure 8 would suggest that Deere is definitely the most profitable company, by quite a large amount. The influence of higher interest rates on Financial Services margins in 2023 is very apparent in Figure 8, as is the reduction in profit margins across all three companies in 2024. The trend since 2021 implies AGCO has done the best job at converting growth in revenues into growth in operating margin, growing its margin from 11% to 13%, while CNH’s margin has dropped from 11% to 10% and Deere’s margin has increased from 18% to 19%.

It is informative to look at the margins across each industry, shown in Figure 8, compared to Figure 7. Deere has strong margins in all segments, and much stronger margin than CNH in Construction in particular, where CNH is operating with a single-digit operating margin. Interestingly, CNH has better Agriculture margins than AGCO, but CNH’s low margin in Construction offsets this, resulting in AGCO having a better overall operating margin than CNH, as shown in Figure 7.

Because AGCO segments its business by geography, AGCO’s quarterly data gives good insight into where its profits are strongest (Figure 9). South America, and in particular, Brazil (not shown but discussed in earnings calls), had been a very positive contributor to AGCO’s bottom line until 2022. It was still the highest-margin region in 2023, but has clearly suffered badly over the last twelve months. Europe and the Middle East, by contrast, has been steadily growing over time. North America had a strong 2023, although margins are still not that high, while Asia, Pacific and Africa regions are now fairing worse in terms of profitability than they were in 2020.

Why I hold what I hold

Although there is more to each company than just the operations data shown above, I think these trends in revenue and operating profit highlight why I hold Deere and AGCO, but not CNH, and why I hold Deere at a higher portfolio weight than AGCO.

To me, Deere is the strongest company. It is the largest, it has the highest operating margins, and both revenue and margins have been increasing with time. In particular, it covers the vast majority of the North America markets.

But AGCO is strong in Europe and, being a smaller company, I believe has more opportunity to grow rapidly and improve margins than Deere. Deere’s profit margins show Agriculture is the more profitable segment than Construction so, while Deere is not as relatively exposed to Agriculture as AGCO, this does provide AGCO with the opportunity to achieve higher overall margins due to its greater single-industry focus.

In contrast with AGCO and Deere, I just don’t see enough rationale to hold CNH in preference to either of the above. It has neither the size or industry diversification of Deere, or the market focus of AGCO (in terms of industries and geographical presence). Its margins, in aggregate, are not as good as either Deere or AGCO.

Valuations

At the time of writing, DE 0.00%↑ is trading at a Price-to-Earnings of 13, roughly in the range where it was operating since COVID until January 2023. Price-to-Tangible-Book ratio is around 6, Price to Sales is between 1.5 and 2, and Price-to-Free-Cash-Flow ratio is around 7. Enterprise Value to EBITDA is between 10 and 11.

AGCO 0.00%↑ has an Enterprise Value to EBITDA of over 6, relatively high by recent standards (it has often been below 5), most likely driven by its increase in debt last year to set up its PTx joint venture. Price-to-Sales is close to 0.5, Price-to-Free-Cash-Flow ratio is less than 5, Price-to-Tangible-Book ratio is around 5, but Price-to-Earnings is around 16, slightly lower than in June 2024, but high compared to the recent past.

CNH 0.00%↑ is priced similarly to AGCO, although its Price-to-Free-Cash-Flow is typically much higher, between 10 and 20 in the recent past, although its Price-to-Earnings ratio is currently much lower, at under 7. Does this make it a better, or worse, prospect for the future?

CNH has faired worst over the last 5 years, although its has outperformed AGCO over most of the last year.

What do you think of these stocks? Any other agriculture or agri-tech stocks which are on your watchlists? I have intentionally not covered Selling, General and Administrative, Research & Development, Interest Expenses or Taxes in any detail. Do you think there is enough difference in these categories to sway your opinion on which company appears to offer the best investment?

Thanks so much for this interesting take. I am really aligned with your thoughts on long term prospects and the potential for each of these companies. As I have only recently been investing, I have a much larger holding in AGCO compared to Deere as I feel the valuation is currently better and the long term opportunity greater. However, Deere is an outstanding company and so I do have smaller holdings in that. I also see little to be gained by holding CNH or any other agtech company for that matter given what I get from AGCO and DE.