Investing Strategy: ETFs - Accumulating or Distributing?

Should you invest in accumulating or distributing ETFs?

Every so often there seem to be some questions from new investors on which is ‘better’…. a distributing or accumulating ETF. I thought I’d try to address the differences and provide a comparison in this post.

I’m going to use the S&P 500 index ETFs for this example, as there is easy access to a number of funds tracking this index, and I’m going to focus on funds available in the UK, as that’s where I’m based.

I just want to invest in the S&P 500. Why are there so many choices?

There are lots of choices because there is lots of demand for funds which follow this index. So much interest that it is worthwhile for fund managers to set up a range of funds (or sub-funds) to cater for particular interests. The major differences between the options tend to be the fund provider, whether dividends are accumulating or distributing, the currency or exchange on which the fund is traded, what type of replication of the index the fund uses and whether the fund is currency-hedged (if not in dollars). The fund’s Total Expense Ratio, TER, i.e. the amount the fund provider charges you for management of the fund, is also important and worthy of review.

I will break down these differences using a number of funds provided by several of the largest fund providers - Vanguard, iShares by BlackRock and WisdomTree. I have also added SPY 0.00%↑ as a comparator.

The funds I have chosen for this review are listed below with the pertinent information summarised.

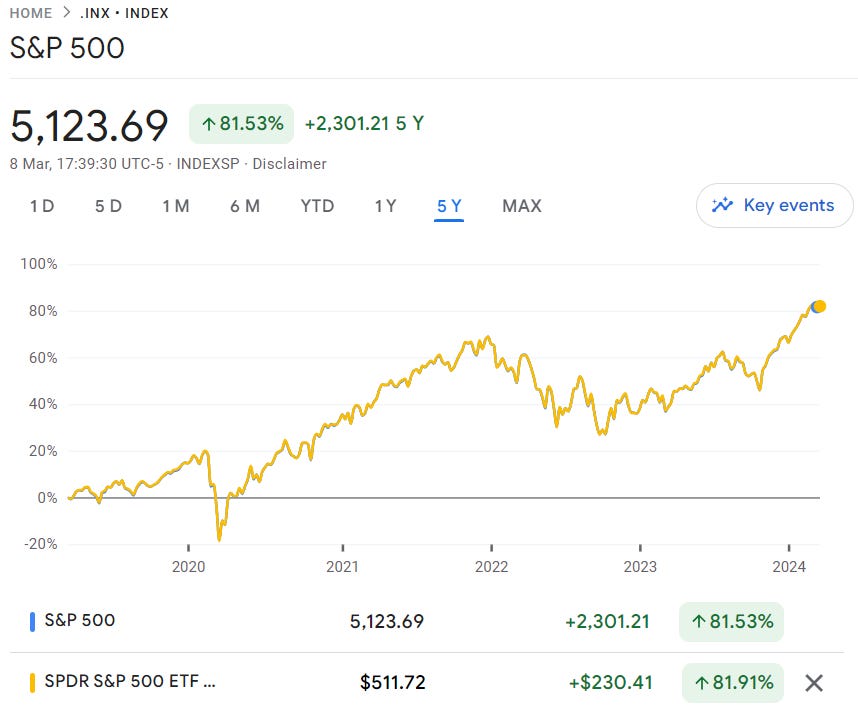

SPY 0.00%↑ is compared to the pure S&P 500 index below (courtesy of Google Finance)

The difference is negligible, meaning SPY 0.00%↑ is a good proxy for the S&P 500 index itself.

Why might you choose a Distributing or Accumulating ETF?

ETFs hold baskets of stocks, several of which may pay dividends. The fund has a choice of what to do with those dividends - it can either distribute them to the fund’s shareholders, or re-invest the dividends within the fund and use the money to increase the value of assets held within the fund. This would make the fund an accumulation fund.

In the UK, dividend income is taxed once above the annual tax-free allowance if the stock is not held in a tax-sheltered account like an ISA. That allowance is £1,000 for the 2023/24 tax year, but drops to £500 for the 2024/25 tax year, beginning 6 April 2024. Whether you hold a distributing or accumulating version of an ETF, you are still liable for dividend tax outside of an ISA, so you might find it convenient to hold the distributing version, which makes dividend income easy to track.

You might be at the point in your investing journey where you actively want to utilise the cash from dividend income, in which case an accumulating ETF might not be suitable for you.

But if you are planning to re-invest your dividends anyway, you might prefer to use the accumulating version. This should enable you to avoid paying the bid/ask spread (albeit small) or any foreign exchange (FX) transaction fees that you might face if receiving cash dividends and manually choosing to re-invest them yourself.

Which fund provides the best return?

Not all funds tracking the same index are equal, but they should be relatively close and there should be good reasons for any differences. The primary factors influencing relative differences between funds will be currency, hedging, and fund expenses. A distributing fund with dividends re-invested should provide similar total returns to the equivalent accumulating fund.

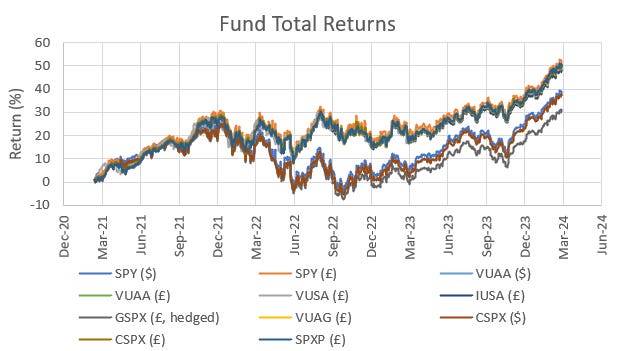

To demonstrate this, I have developed some traces of the above funds over the last 3 years. For funds which trade in USD, I have also converted to GBP using the FX rate at the close of business that day. This is an obvious oversimplification with regards to the fund’s actual transactions and is likely to introduce an error in my analysis, but I will assume the error is small.

In March 2021, 1 GBP was worth around $1.40. Around September / October 2022, during Liz Truss’ (very) brief tenure, the rate dropped briefly below $1.10 per GBP, and has since recovered to something like $1.27. So a fund trading in USD will actually be worth around 10% more in GBP today than it was in March 2021 ($1.40/$1.27). A weak pound makes stocks in USD more expensive to buy, but it also makes them more valuable to sell. You will see that this change in FX rate has provided some benefits to total returns, especially during the late 2022 ‘tech wreck’, which coincided with the weakest GBP.

So how do our funds compare for returns? Below I have taken only the distributing funds to start with, and I am only looking at their share prices. You can see that the funds basically band together - the GBP funds (or the USD funds converted to GBP) have outperformed the USD funds, and there are some small differences in share price between funds. The currency-hedged fund, GSPX, is the worst performer. It is also the fund with the highest fee.

But if I calculate total shareholder returns, including dividends, things look a little simpler.

The banding is clearer and the majority of the fund-fund discrepancies have shrunk. The total returns of the GBP funds are around 10% higher than the USD funds, as expected from the FX rate changes above. The currency-hedged fund remains an under-performer. The divergence in funds’ performance between GBP and USD really starts to become apparent between March and June 2022, when the FX rate began to drop more sharply. In September 2022, there were almost 20 percentage points difference between funds in different currencies, but the USD funds have closed the gap somewhat since, as the GBP has strengthened from that low point. The really key takeaway from this graph is that, except for the currency-hedged fund, there is not really a significant difference between funds after currency corrections, meaning it doesn’t really matter whether you choose a distributing or accumulating ETF, you should get the same total return.

Looking at the cumulative 3 year returns for each fund, the following chart confirms how similar total returns are across funds. While there are definitely some subtle differences, you are going to get relatively similar returns, whichever fund you choose, so long as FX fees and the TER of the fund are comparable. SPY 0.00%↑ seems marginally better overall, and also has the lowest TER.

I have intentionally included one fund with synthetic replication (SPXP for accumulation, SPXS for distribution). Synthetic replication means the fund does not actually hold shares in the companies that make up the index, as is the case with physical replication. Instead, the fund engages in swaps and derivatives with financial institutions intended to mimic the performance of the index. Synthetic funds tend to be a little cheaper and do not have the same dividend withholding tax as physically replicated funds, meaning they can slightly outperform other index funds in principle. However, they do carry counter-party risk from whichever financial institutions(s) they have entered into swap contracts. I suggest you do some further reading if this topic interests you, as it’s not something I know too much about.

Conclusions

For similar TER, most index-tracking funds will perform similarly once corrected for currency and dividend payments - there is no obvious benefit or penalty to selecting an accumulating or distributing ETF

Synthetic funds or currency-hedged funds should be considered carefully before investing to ensure you are happy with the risk those options may entail

There may be good reasons for you to choose an accumulating or distributing ETF based around your specific tax and cashflow considerations, but total returns isn’t one of them.

Thanks for reading.

Sources:

As always, very interesting, thanks! I hold VUAG for the record and happy with that.

One point to quibble with you is this statement "Whether you hold a distributing or accumulating version of an ETF, you are still liable for dividend tax outside of an ISA, so you might find it convenient to hold the distributing version, which makes dividend income easy to track."

I do not think that is correct. HMRC will not expect you to include dividends on an Accumulating fund, but you will be expected to account for the capital gains at the point of sale and this will include the effect of the dividends received. If this was not the case, how would it be possible to accurately assess your CGT on selling the ETF and that would inevitably result in double taxation if you had already counted the notional dividend payments in your dividend allowance. Thankfully however, I don't need to deal with this as I hold VUAG in a SIPP!