Investing Strategy: Is it better to Lump Sum or Dollar Cost Average?

I use the S&P 500 to demonstrate returns over a number of investment strategies

I first published this post in February 2024 on the Trading 212 app in the Vanguard S&P 500 community, under the username, “Anathema”.

Well, this post took me a lot longer to create than I expected! I think I came very close to breaking Google Sheets with the sheer volume of data I used!

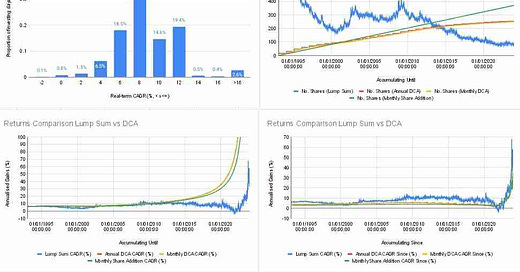

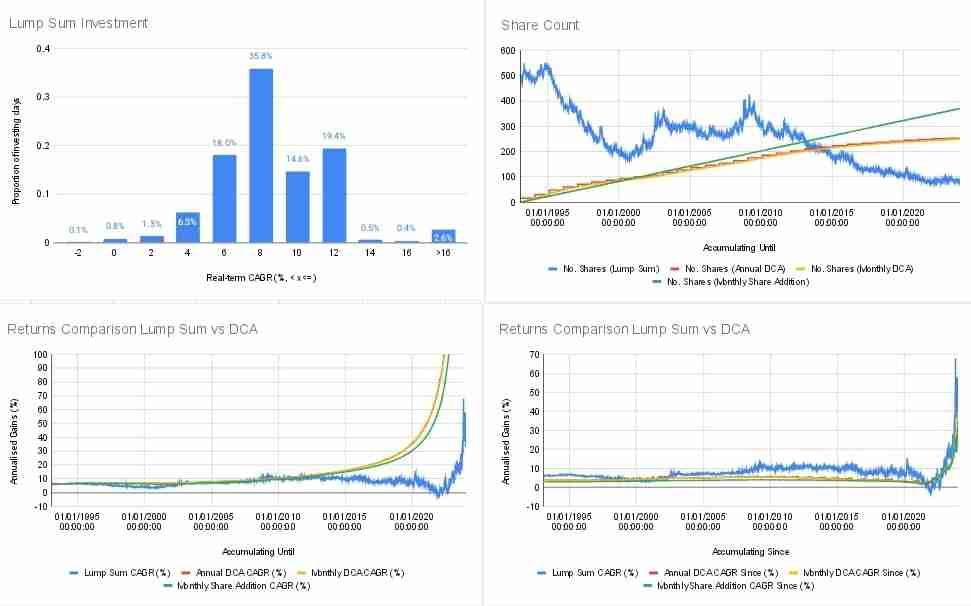

I've seen quite a few posts recently about the best strategy - whether to lump sum invest or DCA, and whether to DCA monthly, weekly or daily. Conventional wisdom / previous work suggests a lump sum strategy is best 2/3 of the time. But by how much?

Method

I took 31 years of daily close data for SPY (from 1 Feb 1993 to date). I used SPY because it has been around much longer than ETFs like VUSA. Because SPY is a US stock, I also took the daily closing GBP/USD exchange rate to convert share price to GBP, or investing amount to USD. Because this is such a long time frame, I also took monthly inflation data from the UK's ONS to adjust invested quantities or returns for inflation.

I took what I think is a moderate investment amount per month for most people (roughly £20/wk, or £83/month in today's money) and converted that into an equivalent annual investment (around £1000 in today's money) or a £31k lump sum. I then calculated how many shares I could have bought with that amount as either a lump sum or as a regular investment, inflation-adjusted, over time since 1993. I assumed investments were made on the first trading day of the year or month respectively.

The cumulative effect of inflation has been to broadly halve the spending power of £1 since 1993. So an £80/month investment now is equivalent to an approximate £40/month investment in 1993. The cumulative amount invested from each of these strategies assessed was approximately £31k in today's money.

I then calculated a few different sets of returns:

> For lump sum, I assumed the inflation-adjusted lump sum could have been invested on any SPY trading day available since 01 Feb 1993 to date. I then calculated the annualised returns since that date.

> For annual or monthly investments, I calculated two sets of inflation-adjusted annualised returns: a return assuming regular investments from Feb 1993 until any specific date, then holding to the current day; and an annualised return assuming regular investments starting on the particular trading day and continuing (inflation-adjusted) to the current day.

> I also calculated annualised inflation-adjusted returns, assuming a single share was purchased at regular intervals, rather than assuming a fixed quantity of GBP was invested at regular intervals. This strategy requires almost £60k in today's money.

Results

> my study confirmed long-term real returns of 6% - 7% per year have been observed once accumulation stops

> my study confirmed that where regular investments continue to the present day, long-term returns are around half of what they are without continued investments (as you are continually buying at the latest prices) - between 3% and 4% per annum (real-terms)

> Where regular investments have continued until the last couple of years, returns are far higher than the 6% - 7% per year. I expect this is because of the very strong market conditions seen since Covid, without a strong or extended bear market pulling average returns down (despite 2022). Also, where there has been less than a year elapsed, annualised returns requires extrapolation and can lead to very high or very low estimated returns, which are probably unreliable.

> A lump sum strategy would have returned 6% or less in real-terms on roughly 28% of available trading days ie my study confirms the approximate one-third / two-thirds split between DCA and lump-sum strategies.

> There is very little difference between returns seen through using an annual or monthly investment strategy - both strategies ultimately result in holding a similar number of shares. Only the one-share-per-month strategy underperforms, and even then, the difference is minor in the long-run.

Conclusion

You are more likely to do better with a lump sum strategy, but few of us have the capital to fully utilise this strategy, preferring to add money as we earn it, and - for me - a roughly 1 out of 3 chance of underperforming is quite high. Assuming a regular investment strategy is pursued, it seems that it is more important to add money consistently than the particulars of the investment frequency.

In summary, as expected, time in the market dominates returns.

This is very interesting and I was quite surprised how the outcomes were fairly similar between the two approaches. For my investing I use both strategies in different situations. This is influences by which trading platform I am using (i.e. their fee structure and whether I can buy fractional shares) and also the nature of the equity I am buying influences by approach. For example, my SIPP (and ISA) is in a platform where I pay £4 per trade and I cannot buy fractional shares so I tend to save up capital and then use the lump sum to buy a decent sized allocation when I feel the price is within my range of acceptability. I may come back an buy more later but I hate overtrading on that platform due to the fees and by its nature my SIPP is 'buy and hold'. In T212, I have secondary account which is really where I experiment and try different things and due to the fee structure and fractional shares I but a lot more US shares there and all with a DCA approach. Thanks for the article.