Investing Strategy: Return on Capital metrics

How and why to calculate Return on Assets (RoA), Return on Invested Capital (ROIC), Return on Capital Employed (ROCE) and Weighted Average Cost of Capital (WACC)

I first published this article in February 2024 on the Trading 212 app in the Value Investing community, under the username “Anathema”.

I saw a post a little while ago by someone who was struggling to get clarity on ROIC calculations. I thought I'd lay out what I do, but I appreciate the challenge - it is quite possible you will find alternative calculations trying to achieve similar objectives. If you disagree with me, please drop a comment and tell me why! I'm always keen to improve my analyses!

Sorry, it's (yet) another long one.

Return on Assets (ROA)

All companies have Assets, which they use to generate earnings. As an investor, the key question is "how much money does this company generate for each pound (or dollar or euro) it holds in Assets?" The lower this number, the more assets a company must have to generate its target earnings and the capital to generate those assets must come from somewhere. So this metric gives you a hint into how capital-intensive a company might be.

I calculate ROA as simply Earnings divided by Total Assets.

Return on Capital Employed (ROCE)

Looking just at total assets ignores the fact that all companies have Current Liabilities i.e. money which will be leaving the company in the next 12 months. It is reasonable to assume that the money required for current liabilities is not going to be available to generate earnings by the end of the coming 12 months. It is also a reasonable assumption that Receivables (money included in Current Assets which is not yet available to the company but is due within the next 12 months) WILL be available to generate earnings within the next 12 months. Therefore, it follows that a company's earnings are more reasonably generated by the total assets, less current liabilities.

As those current liabilities are not "employed" by the company to generate income, Capital Employed is defined as (Total Assets - Current Liabilities). I calculate ROCE as:

ROCE = EBIT / (Total Assets - Current Liabilities)

(where EBIT = Earnings Before Interest and Taxes)

In this instance, it makes sense to use EBIT and not Earnings or Net Income, because debt repayments, interest charges and tax to be paid in the coming year are included in current liabilities, and you are trying to avoid the influence of these elements.

Return on Invested Capital (ROIC)

Similar to Capital Employed, not all of a company's available capital is invested in generating product for sale. For example, cash and short-term investments are held as available liquidity and are not put to work. Conversely, although current liabilities are GENERALLY not available to generate income for the company, money previously borrowed either as debt or as lease liabilities has already been put to use (or it would be showing on the balance sheet as cash).

Invested Capital is therefore defined as (Total Assets less Cash less Short-term investments less Tax assets), minus (Current Liabilities less Current debt less Current lease liabilities).

ROIC = (EBIT × (1 - tax rate)) / Invested Capital

In this case, EBIT is adjusted to reflect the company's tax rate. The tax rate is calculated as tax expense divided by EBIT.

Weighted Average Cost of Capital (WACC)

In all of the above cases, a company requires capital with which to generate earnings. While existing capital can be exchanged between assets, such as selling property or equipment to generate cash (which would not affect ROA or ROCE but would affect ROIC), if a company requires fresh capital, there is generally a cost to the company.

Fresh capital can come in the form of new debt, which carries an interest rate charge, or by issuing new shares to increase the company's equity. If issuing shares, potential investors will have to be enticed to buy this company's shares in preference to other equities on the market. This enticement is usually the level of return expected for the company over the market rate, which itself carries a premium compared to a risk-free imvestment. The expected premium for the company over the market is determined by the company's Beta value, and the market premium is determined by the market returns less risk-free returns (typically government bonds).

The cost of capital for a company can be split into its cost of debt and cost of equity, then weighted to give an average cost to the company to bring in fresh capital, based on its level of debt and level of equity.

Cost of Debt = Interest Charge / Total Debt × (1 - tax expense / net income)

Cost of Equity = Risk-Free Rate + Beta × (S&P500 Returns - Government Bond Returns)

WACC = (Stockholder equity × Cost of Equity + Total Debt × Cost of Debt) / (Stockholder equity + Total Debt)

Great. Now what do I do with these numbers?

Broadly, you are looking for a company that earns a greater return on its capital than it costs to raise capital.

A company has relatively few choices with what to do with its earnings. It can accrue cash on its balance sheet. It can spend those earnings on investments for use by the company (for example, on investments in new plant and equipment). It can pay down debt. Or it can give the money to shareholders, either as a dividend or by buying back its own shares.

If the company is accruing cash, you may wish to look at ROA or ROCE. If paying down debt or distributing to shareholders, ROCE might be more informative. For effectiveness of reinvestment, ROIC might be most useful.

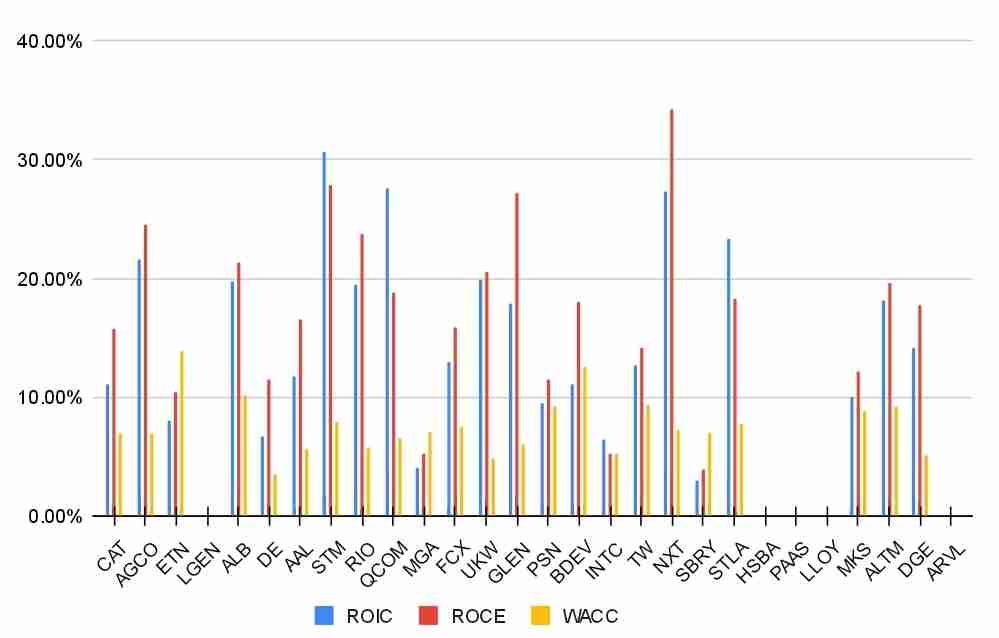

I personally like ROIC, as I believe a company should be either reinvesting for growth or distributing its earnings. But I also like to see ROIC and ROCE as relatively similar, which implies relatively low debt vs. cash held, and relatively low cash (or debt) as a proportion of assets. Where there is a marked difference, I usually investigate further.

In the screenshot below, I have shown how the majority of my portfolio compares for ROCE, ROIC and WACC. The data used depends on when I last reviewed the stock, which may be 2022 data in some cases.

I hope this has been useful. What do you think? Which metrics do you prefer and how do you use them?

Very clear explanations of these terms which I would readily admit I have not previously fully grasped, particularly WACC. Its interesting, looking at your graph that the ROCE for the two housebuilders (TW & BDEV). One might expect this measure to be similar for these two companies, but it is quite different and you can see here the effect of the large cash pile that BDEV has had on its balance sheet for the past few years. Thank you very much!