(someone else's) Valuation: Rolls Royce

Breaking down the Simply Wall Street Discounted Cash Flow Model

I recently had a discussion recently with someone who felt my Rolls Royce valuation was too conservative and would have cost anyone who agreed with me a considerable amount of money. Recent history has shown that individual to be correct, in that the price has risen considerably above my estimate of intrinsic value, but it’s always easy to be right with hindsight. But was my valuation unreasonably low? Or is the current price based more on sentiment than fundamentals?

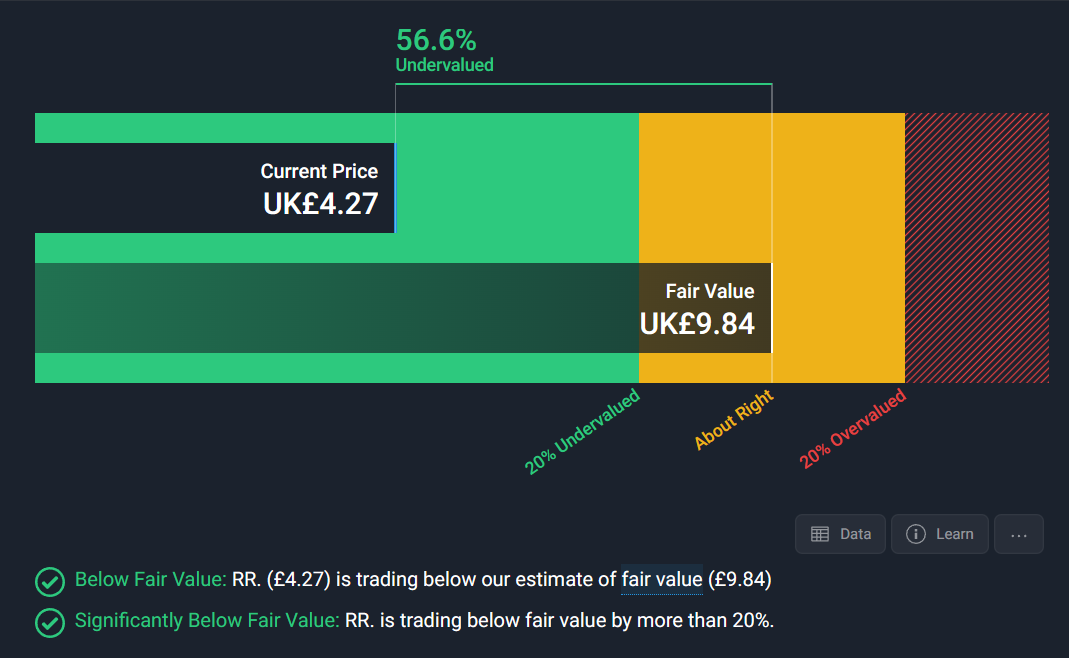

I thought this discussion actually gave me the opportunity to break down and compare my own approach with an alternative, far more optimistic, valuation. For this purpose, I will use Simply Wall Street’s valuation, currently suggesting Fair Value for Rolls Royce (RR.L) is £9.84. This is between 3 and 4 times higher than I currently expect.

Source: Simply Wall St

What Information is used for a Fair Value assessment?

Both I and Simply Wall St use a Discounted Cash Flow approach to judge fair value.

This approach requires:

a risk-free-rate

the Discount Rate, comprised of: an equity premium; an assessment of the target stock’s beta; information on tax rate, corporate debt and corporate equity

estimates of cash / earnings generation for subsequent years. Simply Wall St uses 10 years’ worth of cash flow projections, I use 5 years of discounted cash flow for my own valuations

An assumption for the growth rate in perpetuity for all times beyond the discounted cash flow, generating a terminal cash flow in perpetuity

I will break these down and compare each below.

Two very important distinctions are worth discussing at this point.

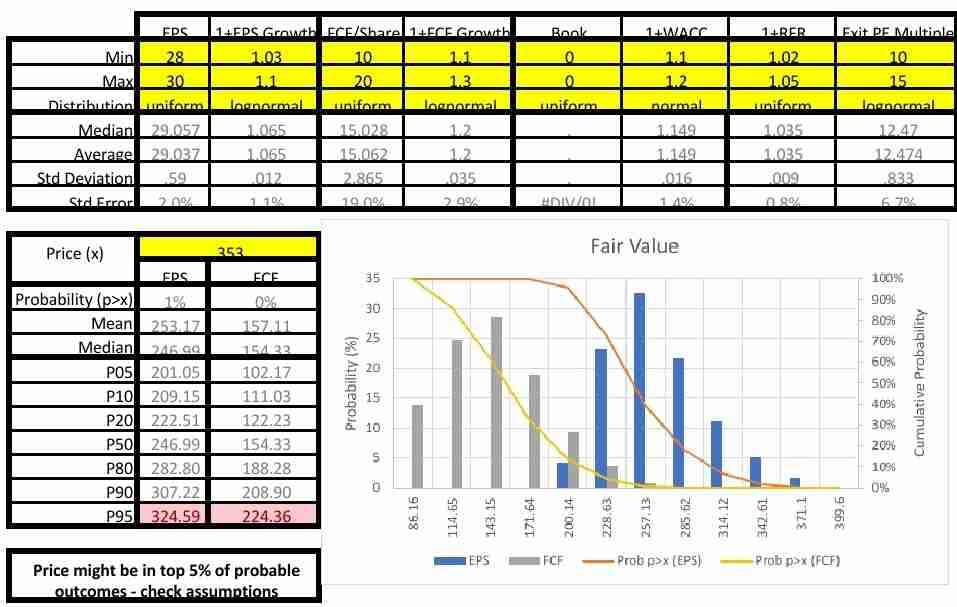

Point #1: Simply Wall St provides a point estimate i.e. it provides a single value for each of the above inputs, leading to a single estimate for the Fair Value of the stock. Whereas I use a Monte Carlo approach to my valuations - I allow a range of values for each of the above inputs, meaning I get a probabilistic estimate for the Fair Value. In other words, I get a range of estimates, each with a probability of the price being higher or lower than that estimate. As with all analyses, if the input data is questionable, the resulting estimates will also be questionable.

Point #2: Simply Wall St provides its valuation based on its estimates for future free cash flows. I generate two sets of valuations - one set based on earnings estimates (as above, my Monte Carlo approach generates a range of projected values), and one set based on free cash flow estimates. I will show both in this post.

The Risk-Free Rate

Typically, a government bond is used to estimate the risk free rate, on the grounds that most government bonds are as close to a guaranteed return as you are likely to achieve.

Simply Wall St is using the 5-year average of UK Government bonds, which it estimates as 1.6% currently.

By contrast, I use US Treasury 5 year yield (^FVX on Yahoo! Finance), and I use a range based on the values observed over the preceding 5 years for this instrument. I use this instrument because a lot of the stocks I hold and value are US listed. It is reasonable to question whether this is the best risk-free rate estimate I could use, given that I am based in the UK.

Currently, the yield for ^FVX is around 4.2%. This is down a bit from the 4.6% seen around the end of September, but up a lot from the (typically) 1% - 2% yields seen between 2016 and 2021 (even though it dropped to around 0.3% around the end of 2020). Consequently, I assume the Risk-Free Rate is likely to remain between 2% and 5% over the next 5 years, distributed uniformly across this range.

The Discount Rate

Simply Wall Street calculates the discount rate as the Cost of Equity, based on:

an equity risk premium, sourced from S&P Global and estimated as 5.48%

the industry unlevered Beta value, estimated as 0.621 for the Aerospace and Defence industry

Rolls Royce’s levered beta, calculated as 0.802. This value is, in turn, based on:

a tax rate of 19%

debt / market equity of 16.44%

Based on the above, Simply Wall St calculates the Cost of Equity as:

Cost of equity = Risk-Free Rate + Levered Beta * Equity Risk Premium

This provides a Cost of Equity estimate of 1.64% + 0.802 * 5.48% = 6.03%

By contrast, I typically use the Weighted Average Cost of Capital (WACC) as my discount rate, however, in this case I also use cost of equity (explained below). The formula I use for WACC is:

WACC = (Total Stockholder Equity, TSE) / (TSE + Debt) * Cost of Equity + Debt / (TSE + Debt) * Cost of Debt

I calculate Cost of Equity as:

Cost of Equity = Risk-Free Rate + Stock Beta * (Market Returns - Risk-Free Rate)

For Market Returns, in keeping with my use of US Treasury yields for the Risk-Free Rate, I use the annualised trailing 5 year returns of the S&P 500 (^GSPC on Yahoo! Finance) as my market returns estimate. These returns have varied between 7% and 13.6% over the last 5 years, with an average of almost 12%.

I calculate Beta for my target stock (in this case, Rolls Royce) by comparing the average of 28-day returns over the trailing 5 years of the stock vs the market (in my case, the S&P 500). This means I calculate Beta as around 1.1 up to the end of 2023. For reference, Yahoo! thinks Beta for Rolls Royce is currently 1.76.

With the above risk-free rate, beta and S&P 500 returns, I estimate Rolls Royce’s cost of equity was around 14.8% as of the end of 2023, and has averaged roughly 13% between 2018 and 2023, reaching as high as 18.5% in 2021. With the current value of Beta, rather than the 1.1 I have used for 2023, these values could be even higher now.

Cost of debt is fairly simply the interest cost from the income statement, divided by total debt, which I believe was running at around 9% as of the end of 2023, down from around 11% in 2022.

As Rolls Royce actually has negative equity and high debt, my WACC calculation does not provide sensible results in this case, hence I default to the cost of equity for my Rolls Royce valuation. However, if I had used cost of debt, I would have been using values of 10% +/- 1%.

When I valued Rolls Royce in February 2024, based on their FY2023 results, I assumed the future annualised WACC could be anything between 10% and 20%, distributed normally within that range. I used 10% as the low value as, with a cost of debt of 9%, I believed it quite unlikely that RR’s cost of capital could be less than their cost of debt, even if they had no equity.

That gave me an average WACC of 14.9%. Clearly, this is markedly higher than the 6% Simply Wall St are assuming, but is close to my current estimate for WACC.

Estimates of future cash flows

Simply Wall St use the following estimates for future cash flows:

I have broken out the value being created due to equity increase over 10 years and the terminal value related to the perpetual cash flow generation. I have also added equivalent calculations for a 5 year discounted cash flow period to compare more directly to my own calculations.

It is apparent that Simply Wall St has very little data for 2028 and beyond. Simply Wall St use an estimation scheme where there is inadequate data, to take the growth from the latest estimate available to the in-perpetuity growth rate assumed, which is what is occurring between 2029 and 2033.

To me, the growth rate from 2026 to 2027 looks anomalous, compared to the growth rates assumed in 2026 and 2028. I wonder if that is because RR have provided guidance for 2027 explicitly. But does that make it more or less likely that the 15% - 20% growth rates assumed for 2025, 2026 and 2028 will be achieved?

I find it reassuring that the present value of future cash flows increases fairly linearly, suggesting no single year is particularly influential to the future cash flows, and I also find it reassuring that the 5 year average compound annual growth rate (CAGR) is around 15%, with the 10 year CAGR around 10% - neither value is that unreasonable.

By contrast, I had assumed the medium term growth rate for Rolls Royce is likely to be between 3% and 10%, so definitely on the low side compared to Simply Wall St. Boeing are expecting that the growth in the global number of jets will be around 3.5% per annum on average for the next 20 years and expecting passenger seat miles to increase roughly 5% per annum over the same period. Widebody airport capacity growth is in the range 1% - 2% per annum since 2013. This is why I pitched my growth rate at between 3% and 10% per annum. Normally, I would use annualised growth rates in earnings per share or free cash flow per share, but Rolls Royce has been highly volatile over the last seven or so years, as seen below (data from their annual report or via my own calculations, ‘adj’ normalises the data for the 2023 diluted share count, recognising the 2020 rights issue). For this reason, I prefer to use market outlook projections.

As a deeper dive, look at the annual revenues and year-on-year growth, shown below. The -100% revenue points show the points where certain segments left the company reports, which is by itself quite significant to reflect on how much the company has changed over this time period.

Source: Rolls Royce annual reports

2023 revenues are close to those seen 2016 - 2019, with similar revenues from civil aerospace, but a higher contribution from Defence and Power Systems. Growth has clearly been impressive since Covid, but how much longer can growth continue at these kinds of rates? Civil aerospace growth has accelerated over 2022 and 2023, as has Defence (slightly), but Power Systems and New Markets growth is slowing (albeit still growing).

In terms of underlying profit and year-on-year changes in profit (shown below), it is clear that Rolls Royce is now earning more profit than it has for some time, particularly from civil aerospace. Can this growth in profitability continue long-term?

Source: Rolls Royce annual reports

Terminal Value and Intrinsic Value

Both Simply Wall St and I use a model similar to the Gordon Growth Model to estimate the terminal value, or the cash flows generated in perpetuity. In principle, this assumes that the stock can grow indefinitely at the Risk-Free Rate, given its Cost of Capital. The formula is corrected to present value terms, as below:

Terminal Value = ((Earnings or Free Cash Flow at end of discounted cash flow period) * (1 + risk-free rate) / (cost of capital - risk-free rate)^(years of discounted cash flow)) / shares outstanding

However, because the cost of capital and risk-free rate could be quite close in value, which could lead to an astronomical terminal value estimation, I apply a cap to my calculated terminal value to ensure the price/earnings ratio does not deviate too far from historical expectations.

As can be seen from the breakdown below and from the table above (Simply Wall St values marked as diamonds in the charts below), there is not a huge difference in the equity increase from discounted cash flows between my estimate and Simply Wall St’s estimate, but there is a very substantial difference in the terminal value calculated. It is also apparent that Simply Wall St expect the present value of equity generated over each of the next 5 years to be higher than the previous year, whereas my higher discount rate and lower growth rate means that I expect the present value of subsequent years to be less than that of prior years. However, the primary source of the large disparity between my intrinsic value estimate and that of Simply Wall St is down to the estimate of terminal value / in-perpetuity cash flows. It can also be seen below that my present value is higher on an earnings basis than on a free cash flow basis.

Breaking Down my Monte Carlo

So the question remains to be answered: is my intrinsic value estimate a reasonable representation of likely future values for Rolls Royce? And that will come down to whether you believe Rolls Royce’s future price/earnings is likely to stay in the 10 - 15 range, whether you think Rolls Royce’s growth rate will far outstrip projected market growth, and whether you think Rolls Royce will be able to reduce its cost of equity, primarily through a lower beta and more stable share price in the future.

My Monte Carlo simulation runs 500 cases across the ranges of inputs I state. Below I have broken down the results of each of those runs as a function of each of the input variables, to help you (and me) understand which factors are most influential in determining the intrinsic value. I have kept the share price at 353p, which is where it was when I wrote my last valuation. However, it is worth bearing in mind that the price is currently 427p with no new financial data i.e. no change in the fundamentals from those discussed above.

As a reminder, these are the parameters I used for my last valuation. As the Monte Carlo estimator is random, each time I run the calculation I will get a slightly different result - the graph below is what was in place when I wrote my previous valuation, here.

Below is a breakdown of the influence of each of the input parameters, although I have had to rerun my analysis to generate these numbers, so they may not agree perfectly with the results from my previous valuation.

The discount rate, my WACC parameter, is clearly a highly influential factor, with low discount rates required to justify the higher valuations. It can also be seen that the terminal value makes up between 40% and 70% of the intrinsic value, and, for earnings per share at least, a higher present value of discounted cash flows tends to lead to a higher relative influence of terminal value. This may be due to the relatively narrow variation I provided in EPS (standard error of 2%), versus the wide variation I allowed for Free Cash Flow (standard error of 19%). Generally, there are no other clear trends suggesting any one input factor, with the ranges I ascribed, are driving my valuation.

Looking at price/earnings, with Simply Wall St projecting a 5Y intrinsic value of £8.24 on a present value of 30.3p on its 5th year (see previous table), Simply Wall St is suggesting Rolls Royce should command a price/free cash flow ratio of around 27. My Monte Carlo approach, with my constrained terminal value, means my price/earnings or price/free cash flow ratios are closer to 15 to 20 (higher than the ratio of 10 - 15 implied by my exit multiple constraint, as that is only constraining the terminal value, not the equity portion of the share price).

The Bottom Line

To achieve valuations much above 300p requires a discount rate below 10%, which I personally don’t believe is supported by Rolls Royce’s current cost of capital. It may also require P/E multiples considerably in excess of 15, which would be high by Rolls Royce’s historic standards. However, if you think both of these assumptions are justifiable, perhaps you can believe Rolls Royce should be valued significantly above 300p. For me, to maintain a margin of safety, I continue to prefer to keep my investment to an average price of around 250p and I continue to believe that price above 300p reflects sentiment and not fundamentals.