Valuation: Intel (2024 FY)

2024 wasn't kind to Intel - is it a falling knife, or a value play?

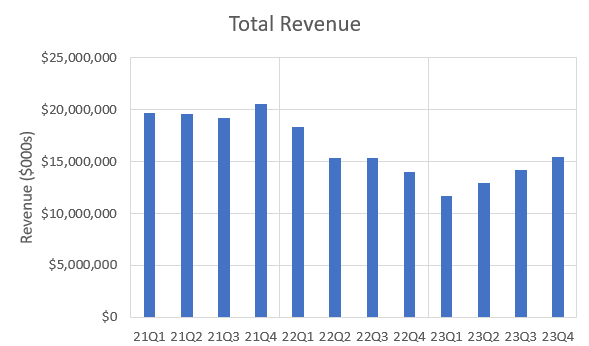

In April of last year, I wrote a Deep Dive on Intel (INTC 0.00%↑ ) , based on financial results up until their end-of-year 2023 results. At the time, I viewed Intel as a turnaround play, with two potential outcomes - continued decline, even if the decline was stymied, or a successful turnaround with opportunity to match or beat AMD. At the time, the INTC share price was approximately $35, and in my former scenario, I estimated a share price of approximately $25 - $30 would indicate fair value.

Well, the share price is now close to $19, so I was obviously not pessimistic enough! Or, perhaps, the share price now offers an opportunity, even if it didn’t last year? Perhaps the board are still making the right changes to protect the company for the future and offer a strong platform for the future? Or perhaps the company is in terminal decline, and the board are throwing good money after bad by trying to swim against the tide.

2024 - a recap

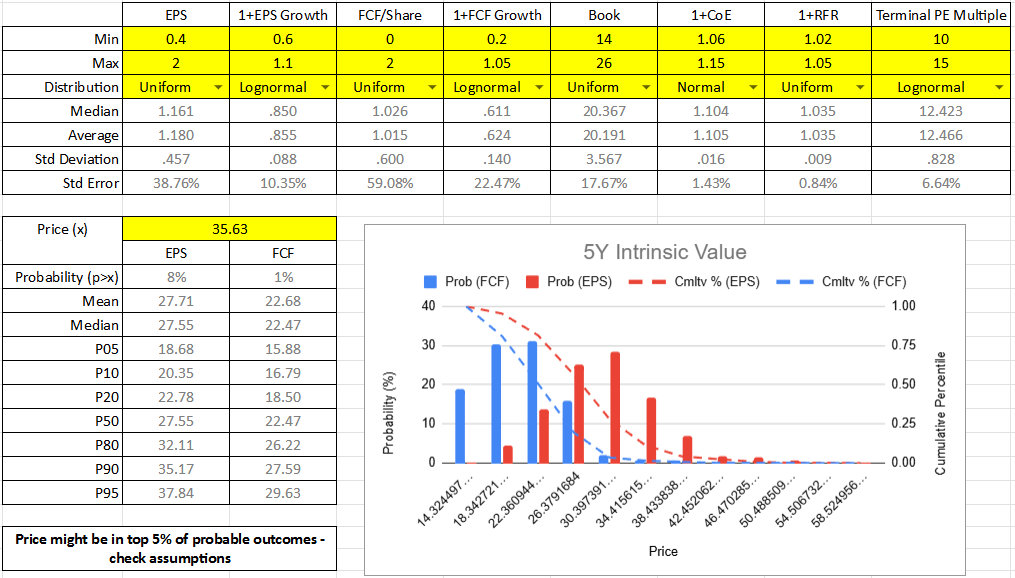

To start with, let’s refresh how I reached my valuation of $25 - $30. Please note - my model is based on random number generators, and I have made some refinements to my models in the last year, so the numbers generated now from re-running my model will not exactly match the numbers I generated originally. However, the numbers are close enough to support this discussion.

Figure 1 shows the inputs that I had assumed for Earnings Per Share (EPS) and Free Cash Flow (FCF) per share, and growth rates. My median share price fair value estimate, based on my current model outputs, is between $22 (based on FCF) and $27 (based on EPS), with $30 indicating the net present value of EPS would need to be in roughly the top quartile of probable outcomes. The model assumes compounded annual expected EPS growth (decline) of -15.5% over each of the subsequent 5 years, and -38% FCF growth to represent continued heavy investment for the future.

At the time, revenue looked like it had reversed the declines seen in 2022, had bottomed, and was once again increasing.

But what actually happened, compared to my estimates? My model had estimated 2024 EPS (Year 1) could have varied between approximately $0 to a little under $2, but the company actually reported EPS of -$4.38 - materially less than I had previously assumed. FCF/share came in at -$3.66 (by my calculations), vs. my modelled expectation of also between $0 and $2.

I simply didn’t anticipate losses of this magnitude when estimating intrinsic value in early 2024, although some reasons are laid out below.

What changed during 2024?

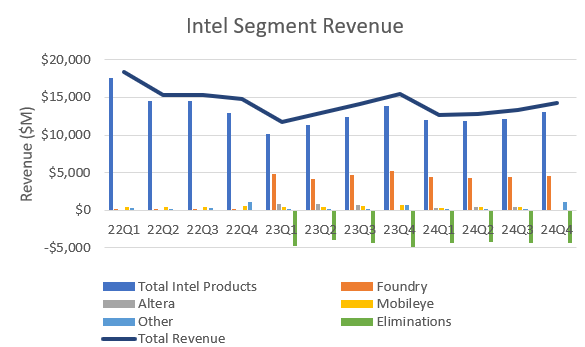

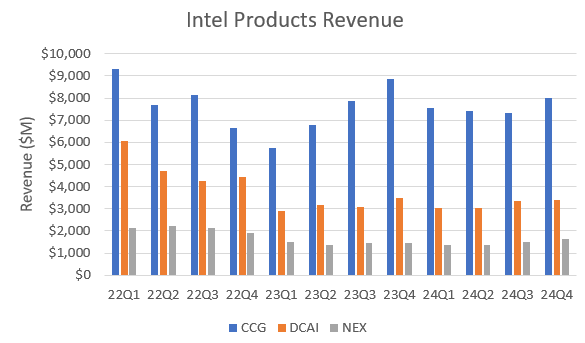

Lots. At the start of the year, Intel restructured its operating segments to separate its Intel Foundry Services (IFS) and its Intel Products group, which incorporated its Client Computing Group (CCG), Data Centre and AI (DCAI), and its Network and Edge (NEX) segments. Intel’s Programmable Solutions segment was stripped out of its DCAI segment, restructured as (wholly-owned company) Altera, and moved into Intel’s ‘Other’ segment, along with Mobileye.

At the end of the year, Intel fired CEO Pat Gelsinger (sorry, I mean Gelsinger elected to resign) and they are currently operating with interim co-CEOs, David Zinsner and Michelle Johnston Holthaus, while a permanent replacement is recruited. Zinsner continues in his previous role as Chief Financial Officer (and Executive Vice President), while Johnston Holthaus was also named CEO of Intel Products. Intel lost Board of Directors member, Lip-Bu Tan, reportedly due to frustrations with Intel bureaucracy, but appointed Eric Maurice (CEO of ASML from 2004 to 2013), Steve Sanghi (interim CEO of Microchip Technology) and Stacey Smith (chair of Autodesk and board member for Wolfspeed).

2024 saw Intel open its ‘Fab 9’ facility in New Mexico, where it intends to implement its 3D packaging technology, Foveros, with its new manufacturing nodes. It launched its Gaudi 3 accelerator and announced the ‘Sierra Forest’ and ‘Granite Rapids’ families of Xeon 6 data centre processors (offering ‘efficiency’ and ‘performance’ cores, respectively), built on the Intel 3 manufacturing node. Intel also announced the Lunar Lake family of processors. As with Meteor Lake and Arrow Lake processors, Lunar Lake is aimed at the AI PC market, but Lunar Lake’s manufacturing is outsourced to TSMC. Lunar Lake, as discussed in the Q3 and Q4 investor calls, is an expensive product with memory on-chip, originally intended as a niche, high-performance product but now being used more widely for AI-enabled PCs, and it will put gross margins under continued pressure in 2025.

Intel entered another SCIP (Semiconductor Co-Investment Programme) with investor Apollo to help fund ‘Fab 34’ in Ireland to build Core Ultra processors using Intel 3 and Intel 4 nodes, intended to support the move to AI PCs. This is a 51:49 ownership stake, with Intel maintaining control, but means Intel will need to pay Apollo for products coming from this fab in the future.

Intel also received up to $3 billion in direct funding from the Biden administration under the CHIPS act. This is in addition to a $7.9 billion funding agreement announced in November. Intel and AMD formed an x86 Advisory Group to support continued development of the x86 architecture in the face of challenges from ARM or other Reduced Instruction Set Computer (RISC) architectures. Other founding members of the initiative include Intel’s main customers Dell, HP and Lenovo, as well as software companies Microsoft, Google, Meta, Oracle and Red Hat, and chip manufacturer Broadcom. Intel and Amazon Web Services (AWS) struck a deal for Intel to build custom Xeon chips for AWS on the Intel 3 node, and custom chips on Intel’s new 18A node.

2024 saw Intel’s ‘5 Nodes in 4 Years’ (5N4Y) strategy, launched in 2021, become effectively 4 Nodes in 4 Years, with the 20A node being quickly sidestepped in favour of 18A, due for a 2025 launch with the Panther Lake and Clearwater Forest processors. Intel claims that the 20A development work has informed the 18A process, but 20A no longer justifies the capital investment originally planned. Arrow Lake, the processor slated for production on the 20A process, instead comes from external foundries, with Intel undertaking packaging work for the chips.

Like Arrow Lake, Panther Lake uses a chiplet, or tile, design. However, whereas Arrow Lake chiplets will be sourced externally, a lot of the Panther Lake tiles will be produced in Intel’s foundries on the 18A process, with only some tiles coming from external foundries. Intel acquired all of ASML’s 2024 production volume of High-NA EUV machines, potentially giving Intel a head-start on the latest generation of nodes, starting with its 14A node currently under development, with 10A to follow. Intel intends to bring more tiles in-house for future products, like its Nova Lake processor. Starting with 18A, Intel expect the proportion of EUV wafers (and the cost and margin benefit that they bring - Intel expects price to rise three times as rapidly as manufacturing costs) to increase substantially in 2025, from a base of around 1% in 2023 and 5% in 2024.

However, 2024 also saw some issues reported with Intel’s 13th and 14th generations of Core processors, built off the Intel 7 node (one of the earlier nodes on the 5N4Y roadmap). The issue was linked to oxidation and voltage instability, with Intel believing it had resolved the issue before the end of the year.

By the Numbers

So was 2024 that bad for Intel? It sounds like most of their development activities progressed to plan?

Reviewing the quarterly earnings calls:

In Q1, Pat Gelsinger indicated Intel believed Q1 would be a low point, with performance strengthening throughout the year, helped by AI PC sales, NEX and data centre growth. Zinsner expected free cash flow to be broadly flat during the 1st half-year, while Gelsinger stated Intel expected over $500M in accelerated revenue in the 2nd half of 2024, following the launch of Gaudi 3 for data centres. At this point, 6 customers had been signed to Intel 18A products, including Microsoft.

Q2 saw profitability below expectations, with China export license restrictions causing headwinds, and brought announcements of a 15% headcount reduction with consequent reduction in Operating Expenses (OpEx), and over 20% reduction in Capital Expenditure (CapEx) vs. the original 2024 plan. Gelsinger reiterated that revenue growth through the year was expected, but at a slower rate, with Q3 seeing particular issues with inventory. Intel Foundry was expected to show its greatest losses in 2024, before moving towards breakeven in 2027 (as stated in the Q4 call).

In Q3, Intel’s stated it was moving its Edge business from the NEX segment to CCG, enabling NEX to focus on networking and telecoms. This, and other portfolio changes, will result in new segment reporting in 2025. Profitability was impacted from restructuring charges from actions announced in Q2 and impairments, including a significant Intel 7 node impairment charge and a Mobileye goodwill impairment. Gaudi 3 launched, but with slow uptake, causing Gelsinger to declare the $500M revenue target stated in Q1 would be missed. Zinsner telegraphed there would be a major cash charge landing in Q4, related to the restructuring actions. Zinsner stated the business was now sized for revenue growth of 3% - 5% per year, but with ability to increase this to accommodate growth of 7% - 9% if demand required. Zinsner also declared some 2025 headwinds were expected, with non-controlling interests from Mobileye and IMS businesses and the SCIP initiatives resulting in significant payouts to partners.

By the Q4 earning call in early 2025, Gelsinger was gone and MJ Holthaus and David Zinsner were presenting as co-CEOs. Holthaus recognised that Intel is not currently making inroads into the cloud-based AI data centre market, despite having a leading position as host CPU for AI servers. Zinsner guided for a poor 2025 Q1, down 11% - 18% from 2024 Q4, while recognising that Q1 is historically also Intel’s weakest quarter. N.B. Q4 saw a tailwind from government grants in the quarter that helped improve gross margin. The non-controlling interests mentioned in Q3 (primarily related to SCIP initiatives and Mobileye) are expected to account for $500M - $700M in 2025, increasing to around $1.2 bn - $1.4 bn in 2026. As well as the aforementioned portfolio changes, Intel declared their auto business would also move to their CCG segment in 2025. 2025 should see lower CapEx, as Intel grows into the new capacity installed in recent years.

Figure 4 shows that Intel Products did indeed grow over the course of the year from a low point in Q1, as anticipated at the start of 2024. The introduction of the Intel Foundry segment in 2023 has also given rise to a significant level of eliminations, as the Intel Products group is also the major customer for Intel Foundry. Figure 5 shows that Intel Products are dominated by their Client Computing Group segment, which was fairly flat through most of the year, effectively stalling the improving trend seen through 2023. Despite the slow ramp of Gaudi 3 sales, DCAI did increase marginally through the year, but overall the DCAI segment remains considerably below levels seen in 2022. However, the increase in the second half of the year was not enough, and 2024 revenue of $53 bn meant Intel ended the year 2% below 2023, itself 14% below 2022 revenue of $63 bn.

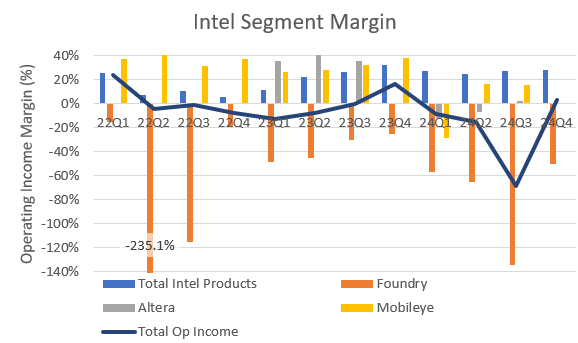

Looking at operating profit margins by segment, it is immediately apparent that Intel Foundry is currently a significant drain on operating income, particularly in Q3.

Gross margin for the Intel Products Group showed an increase in 2024 back to approximately 51%, with NEX offsetting declines in DCAI. However, Foundry is really weighing on margins, pulling gross margins down from ~51% to 27% across all segments, although Cost of Goods Sold eliminations means the overall gross margin for Intel is more like 32% - still showing a year-on-year decline of over 7 percentage points from 2023.

Restructuring charges cost Intel almost $7 bn in 2024, playing a major part in explaining Intel’s operating loss of $11.7 bn. However, clearly this isn’t enough by itself to explain Intel’s performance, and some blame must lie at the loss of revenue, particularly in Intel’s Foundry (indicating outsourcing to external foundries) and Other segments (including Mobileye and Altera). Cost Of Goods Sold (COGS) increased, particularly in its DCAI segment, where COGS increased by almost 6% despite revenue only increasing by around 1% from 2023.

The restructuring charge, split between employee severance costs of $2.5 bn, litigation charges of $0.9 bn and impairment charges of $3.6 bn, was worth the equivalent of $1.63 per share over the full year. Intel’s 2024 tax bill of $8 bn included provision for over $6 bn of previously-deferred tax charges, now considered unlikely to be recoverable due to asset impairment and restructuring charges. The tax charge was the equivalent of $1.87 per share, a marked change from net tax benefits recorded in 2022 and 2023. Adjusted for these restructuring and tax charges, Intel's loss for the year would have been around -$1 per share, so closer to, but still below, my assumptions.

Inventory Management

One of the reasons cited by Intel’s executive management team for sluggish growth was inventory burn by its customers. So it is informative to look at their inventory management. As a ratio to COGS, Intel did make improvements in inventory control (indicated by a higher number of ‘turns’ of inventory) in 2023 and have since made further minor improvements (1% - 2%) in 2024. However, compared to 2022, Intel is less effectively converting its Property, Plant and Equipment (PPE) into revenue (a lower number of PPE ‘turns’). This indicates building out of fabs without expanding revenue as much - it should be reasonable to expect PPE Turns to increase in the future, as the products from the new fabs reach maturity.

I have also pulled out the monetary value of the SCIP investments recorded as non-controlling interests, i.e. the amounts invested by, or owed to, partners - as shown in Figure 8, this is fairly inconsequential in the context of overall capital deployed, even though it will have a significant impact to Intel’s income statement in the coming years.

Debt Management

Intel’s interest expense has been increasing since 2022, while interest income and other incomes has been reducing. Total debt has also been increasing, although the increase from 2023 to 2024 was fairly small, at less than 2%. With over $1 bn of interest expense in 2024, Intel now has an effective interest rate on its $50 bn total debt of a little over 2%. At the same time, total shareholder equity has reduced between 2023 and 2024 and, with the increase in non-controlling interests since 2022, common shareholder equity reduced by almost 6% from 2023 to 2024.

This means the total debt to total equity ratio has increased from 40% to almost 48% between 2022 and 2024, and to over 50% if equity attributable to non-controlling interests is excluded. Book value, and tangible book value, have both dropped slightly since 2023, currently around $14 per share tangible value and $23 per share nominally.

Capital Expenditure and Free Cash Flow

Intel has been spending between $24 bn and $26 bn in gross CapEx since 2022, but net of government incentives, this level of investment dropped to $22 bn in 2024. With revenue of $53 - $54 bn in 2023 and 2024, CapEx of $24 bn - $26 bn implies CapEx costs of around 45% - 48% of revenues, which is incredibly high.

Operating cash flow has been growing strongly since 2022, helped in 2024 by many of the operating losses and tax charges being non-cash in nature. This has enabled Free Cash Flow (FCF) per share to become slightly positive in 2024, from a position of close to -$4 per share in 2022 and 2023. This means FCF per share reached the lower end of my prior estimate.

2025 Estimates

Intel is projecting to spend between $20 bn and $23 bn in 2025, but is also expecting significant contributions to this expenditure from partners and the government, and is assuming its net CapEx costs will be $8 bn to $11 bn.

Intel has guided for Q1 revenue of $11.7 bn - $12.7 bn, implying (unofficially) full year revenue of somewhere around $49 bn to, perhaps, as high as $58 bn, considering recent Q1 seasonality. Such results would indicate year-on-year growth of between -8% and +9%. If net CapEx comes in at $11 bn, CapEx/Revenue is likely to be between 19% and 22%, a much lower intensity than during 2022 - 2024. Intel has also guided for Q1 gross margin of 36%, implying gross profit of $4 bn - $4.5 bn for the quarter. Scaled to the full year, this would suggest gross profit of somewhere close to $20 bn, if margins didn’t improve.

Intel is also expecting to spend around $17.5 bn on Operating Expenses (OpEx), a roughly 20% improvement on 2024 (before restructuring and impairment expenses).

If interest expenses are assumed to be ~$1 bn again in 2025, and using Intel’s Q1 tax rate guide of 12% as relevant for the full year, Intel may face a tax bill of around $200M. Incorporating non-controlling interests disbursements of around $700 bn, as assumed in 2025, to $1.4 bn, as assumed in 2026, Intel may see net income of anything between -$100M to +$300M in 2025. This would provide EPS close to breakeven.

If depreciation and amortisation costs, around $10 bn - $11 bn in 2024, remain close to net CapEx then, with government incentive support, FCF per share could also be close to breakeven.

Intrinsic Value

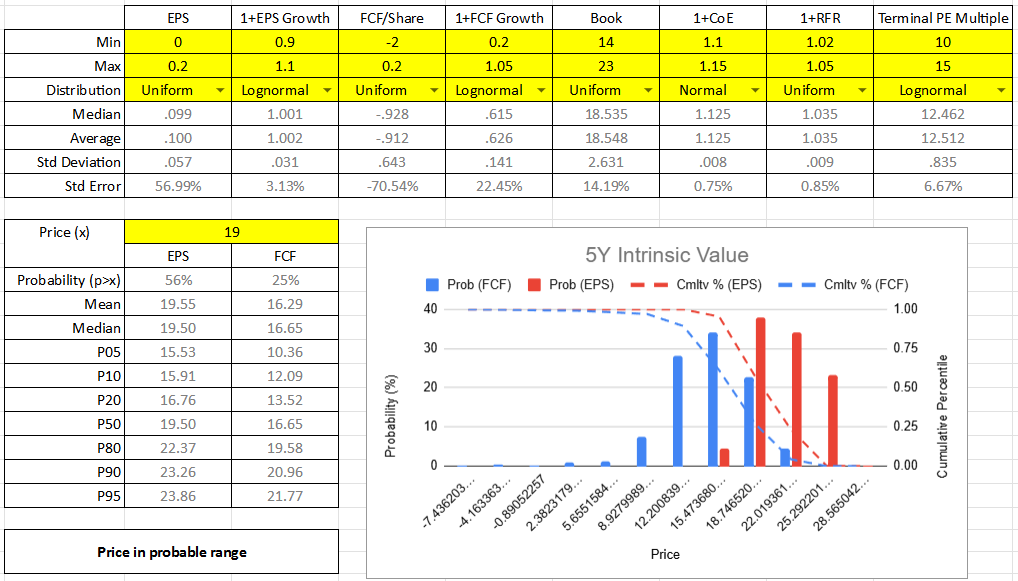

Trying to piece the above discussion together, a new intrinsic value can be estimated as laid out below:

With these assumptions, the Intel share price is dominated by its book value, with net present value of discounted cash flows contributing very little. This also means Intel share price is at risk of further erosion if EPS does not meet breakeven.

Under these assumptions, Intel would appear to be reasonably fairly valued today, or possibly even still over-valued with further downside risk, particularly if EPS or FCF drops below zero in 2025.

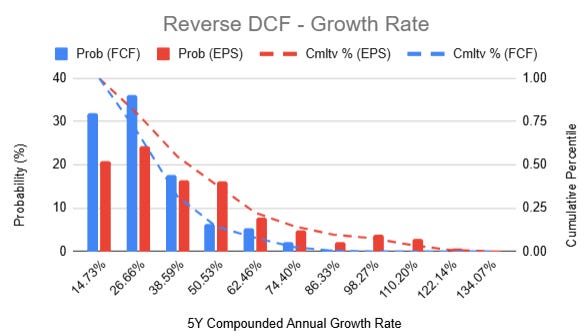

If both FCF and EPS are assumed to remain above zero, a reverse DCF approach can estimate the compounded annual growth rate (CAGR) that may be required to justify the current share price, under uncertainty in other parameters. Such an approach suggests CAGR would need to be around 25% to 30% to balance the upside and downside risks for a share price of $19. 30% CAGR for a company with revenue of $53 bn seems unlikely to me, but equally it is relatively easy to achieve large growth rates when working from a very low base, as is currently the case for Intel's EPS and FCF position. A lot will depend on the production yield and the gross margin that Intel can achieve with their new products.

That being said, I also think this could be the low point of Intel’s turnaround journey. They are completing their business restructuring, they have already invested heavily for the future, but their new products have not yet had much time to penetrate the market. When I initially invested, I knew the timeframe required to see results would be 2025 - 2027. Although I hadn’t anticipated the slow uptake to the 5N4Y strategy, I remain hopeful that 18A and beyond, based on ASML’s High-NA EUV machines, will enable Intel to recover process leadership, as originally envisaged by Pat Gelsinger.

I am definitely not adding to my holding at this point, but I’m willing to accept a further downside risk, that I estimate to be approximately 30%, to see if Intel can retake their leadership position. For me, the two biggest risks facing Intel’s recovery are the lack of growth in their DCAI segment revenue, and the impending drag on profits from the SCIP and Smart Capital strategy, although the rationale for sharing in the investment cost is obvious, particularly with Intel’s current cash flow position.

With my average share price of $27, a further downside risk of 30% from here would imply risk of approximately 50% loss for me. Intel is currently less than 3% of my portfolio, so a 50% loss on this stock implies a loss of approximately 2% of my total portfolio value at the current time. That is enough risk for me to carry without increasing my exposure, and I might even take a small loss and reduce my exposure slightly.

In fact, I recognise I am basically hoping for an irrational result, because my intrinsic value analysis implies that the share price is unlikely to rise above $23 without operating results improving by a CAGR of more than 10% (outside of the range of my estimation). Yet I’m prepared to give the stock another year or so to see what the High-NA equipment can deliver for Intel. As the main US manufacturing competitor to Taiwan and South Korea, I believe the US administration will want to see Intel succeed, but that is a very weak investment thesis.

Maybe I am trying to catch a falling knife, after all.

I keep an eye on options flow and Intel have had some very strong institutional flow recently, so maybe the tides are turning!?