Valuation: Marks & Spencer (LON:MKS) 24H1

My intrinsic value estimation for M&S based on their 1st half 2024 results

I first posted this in November 2023 on the Trading 212 app in the Value Investing community under the username “Anathema”

After their recent elevation back into the FTSE100 and [Trading 212 user] @SamanthaL's post on their recent pop, I thought I'd write up my valuation of M&S. I own this stock, but this is not financial advice - please Do Your Own Research

Sales, Segments & Margins

In my view, M&S are similar to NEXT (which I also valued recently - see my profile) in having a Clothes & Home division with a large physical footprint, but they also have a significant Food division, accounting for around 60% of sales. They are predominantly UK based, with International accounting for only 10% or less of revenues, but nearer 12% - 13% of profits.

In 2019, M&S bought 50% of Ocado, whereby Ocado would deliver M&S groceries. Initially and during Covid, this was a lucrative relationship (Ocado accounted for 35% of profits in 2021), but has since under-delivered (excuse the pun), with Ocado creating a drag of around 5% on profits in 2023 and nearly 7% on TTM performance.

Margins are generally tight, with less than 10% on home & clothes, around 4% on food and around 8% on International. Overall EBIT margin is 5% - 6% and net profit margin is around 3%, with gross margins around 35% by my calculations. Gross and EBIT margins are similar to those seen in 2017/2018, but net margins are now 2x to 3x higher than at that time.

Growth and Returns

Revenue has been growing around 10% a year since 2021, with slightly stronger growth on TTM based on 24H1 results, but 5y CAGR is more like 2% - 3%. On the other hand, EBIT growth (exc. Ocado) has been stellar, EBIT is now around twice its pre-covid levels and 24H1 TTM results indicating around 30% increase in operating income vs FY23. 5Y CAGR on EBIT (exc. OCDO) is close to 30%. EPS has been growing between 10% and 20% since covid and is now almost 3x its prior high of 7.2p in 2017.

M&S has quite a lot of adjustments and restructuring costs each year. After adjustments, ROA is around 4% and ROIC is around 8%. Before adjustments, returns are roughly twice as high.

So what has changed to turn things around since covid? It looks to me like it is primarily restructuring costs and impairments. M&S is also now making more from its financing income, relative to its financing expenses, which is being only partially offset by losses in its OCDO investment. This is significant, though, as Ocado losses have been roughly doubling for last few years and are now around 20% of total net income.

Balance Sheet Strength

Perhaps not surprising, given its Food segment contribution, but the M&S balance sheet looks a bit like a grocer's, with a low quick ratio (0.4 - 0.5), current ratio < 1 and high inventory turns / short cash conversion cycle.

Debt is high, no doubt, although a lot of this is related to leases. Interest cover remains decent, around 3x, and operating cash flow (by my analysis) is over twice debt payments. It has been better in recent history, but it has been worse, too.

A slight concern is that CapEx is not keeping pace with depreciation, but this is at least partially due to selling of some assets and may indicate right-sizing. Depreciation costs are now lower (slightly) than before covid. This does mean that FCF per share is stronger than EPS, at around 26p for FY23 and 41p on TTM basis, compared to EPS of 18p and 20p respectively. FCF has been highly volatile, showing 90% gains and almost 60% falls y/y over the last 5 years, but has been flat to -10% on 5y CAGR over last couple of years.

Fair value

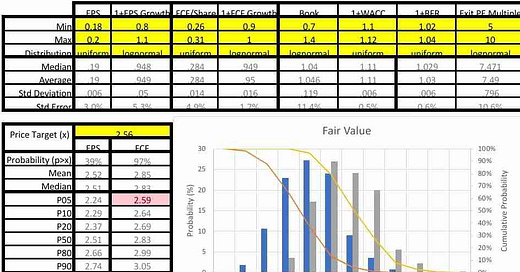

M&S's cost of debt, excluding leases, is relatively high, as is its cost of equity. With an effective tax rate between 20% and 25%, I estimate WACC to be between 10% and 12%.

With earnings being quite low at times in last 5y, P/E has been volatile, but a range of 5 - 10 seems reasonable based on recent performance.

Tangible book value seems to be close to £1 currently, although has been as low as 70p, whereas nominal book value is nearer £1.40.

If EPS is assumed to keep growing at between -20% (due to Ocado losses) and +10% per year, and FCF is assumed to be flat to -10%, I think M&S is relatively fairly priced. Based on FCF, a price of £2.70 - £2.80 may be justifiable, but based on EPS, around £2.50 seems fair.

To me, this is a turnaround play which may have already turned around. I got in at a decent price and will hold for a while and see how the Ocado story plays out.

I've tweaked my graphic again to hopefully further improve the layout of my assumptions. As always, all comments welcome!