Today I thought I’d do something a little difference, and value a company I used to own to check if there is a lesson to be learned.

Parker-Hannifin Corporation was one of the very first stocks I bought when I opened my first investing account with a brokerage in 2021. I bought them because I had heard of the company and I knew they sold products into the industry I worked in. That was pretty much all of my research! I didn’t know how to assess financial statements, I didn’t know how to weigh up the pros and cons of debt vs equity, I didn’t read into the company to realise they were chasing and then closing the purchase of Meggitt Aerospace at the time.

I bought in at $320 per share at the end of March 2021, which, as Figure 1 shows, was basically the high point throughout 2021 and 2022, before it dropped to around $240 - $250 on a few occasions throughout 2022.

After holding for ~ 1.5 years, I’d had enough of the depressed share price and sold at $288 in August 2022, using the movement in GBP/USD FX rate to come out basically at breakeven (I think I made a profit of something like £1 per share!). In hindsight, I sold just before PH started its bull run, which has seen it double from those recent lows, providing a 234% return over 5 years, or a Compounded Annual Growth Rate (CAGR) of over 27%.

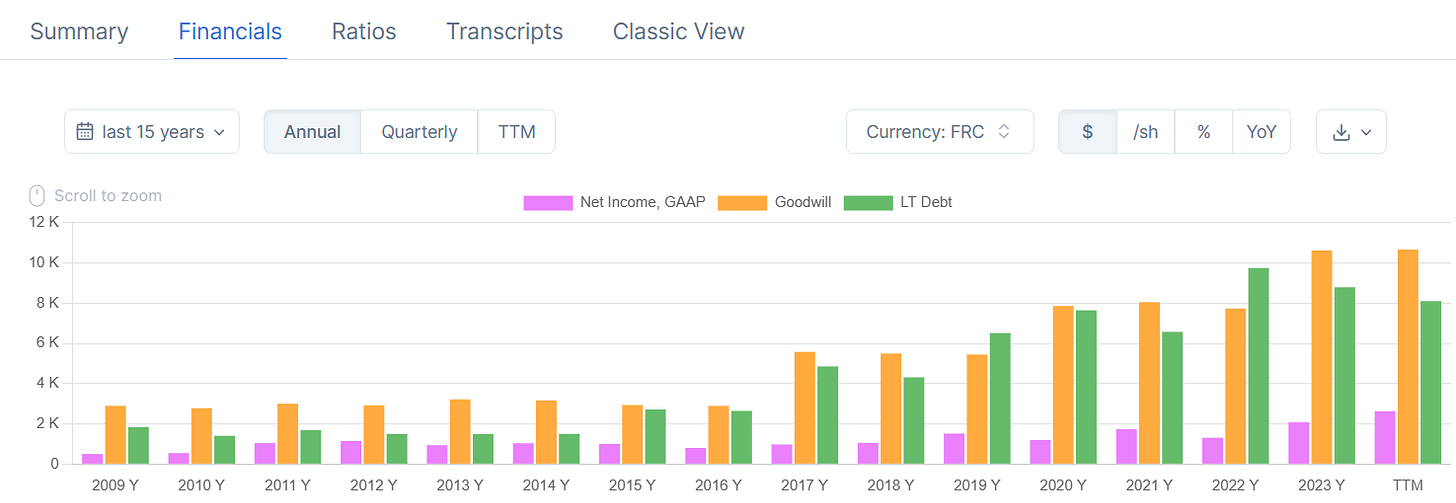

Was I too hasty? By the time I’d sold, the Meggitt transaction was agreed, and I’d read a few books like the Intelligent Investor, advising on metrics like having Debt/Equity less than 40%. As Figures 2 and 3 show, between 2021 and 2022, PH’s debt increased substantially, while earnings decreased. However, a slightly closer look may have convinced me that the debt was affordable, with interest cover of around 10 times (EBIT to Interest Expense in Figure 2). And perhaps I could have researched Meggitt’s business and considered whether I expected earnings to increase in the future, following acquisition - Parker have credited a strong aerospace segment for their most recent earnings, and Covid was always going to be a temporary impact. A bit more research would also have taught me that PH has operated with Debt/Equity above 100% in the recent past, although not with the current levels of net debt / equity.

In fact, a deeper dive might have even persuaded me that, instead of selling, PH was relatively cheap in 2022, given its improving operating margin and relatively low price/book value of ~ 2. But it is also clear that PH is running at below-zero tangible book value, and has been for some time, with Goodwill by itself being roughly equivalent to common shareholders’ equity. In other words, a large proportion of PH’s paper value is due to money they have paid to buy other companies, on the assumption those companies can generate more value in the future than they have cost today.

Net income has grown at roughly 14% CAGR for the last 5 years. The dividend has grown by almost 15% CAGR for the last 5 years. Free Cash Flow per share has also grown at around 15% CAGR over the last 5 years.

With $573M in interest charges on debt of $8.8B,PH’s effective interest rate is around 6.5%. With an effective tax rate of 22%, this is more like 5.1% net. Yahoo! Finance tells me that PH currently has a Beta of around 1.5. With the S&P 500 returning a 5Y CAGR of around 13%, and with a 5Y Treasury Yield (^FVX) of 4.5% currently, this gives PH a Cost of Equity of around 17%. With a 100% debt/equity ratio, roughly half of PH’s cost of capital is from debt and half from equity. This gives an overall weighted average cost of capital (WACC) of around 11%.

ROIC.ai tells me that PH has been averaging around 8% return on capital and around 12% return on invested capital over the last 5 - 6 years. Net profit margin is also in the 8% - 12% range, with current trailing twelve months’ profit margin of a little over 13%. They have also recently deployed a lot of cash, resulting in quite low Cash Ratio, Current Ratio and Quick Ratio values currently. Current Ratio is now below 1, which is not something I like to see, but it does indicate that the company is pushing hard to invest and grow. However, ROIC of 12% also means that the company is not generally growing enough to consistently keep growing dividends at 15% per annum.

If dividends next year were to grow by 15%, but with a long-term cost of capital of 11% and a long-term dividend growth rate equal to the risk-free rate of 4.5%, the Dividend Discount Model implies a PH share price of only $102. To achieve the current valuation of almost $530, the dividend would have to grow consistently at almost 10% annually. This is possible, and PH’s recent dividend, earnings and free cash flow history shows that this has recently been achieved, but is it likely to remain at these levels indefinitely into the future? Maybe - it means PH would need to grow its dividend in line with earnings or free cash flow and continue to grow earnings and free cash flow at their current rates indefinitely, but with a payout ratio of around 36%, this is possible.

And if I run a Discounted Cash Flow analysis with results up to the end of 2023 on Earnings Per Share of $16.23 (on a Generally Accepted Accounting Principles (GAAP) basis), with a ROIC of 12% and a discount factor of 11% (so discount factor = WACC) and a risk-free rate of 4.5% (equal to the current 5Y Treasury Yield), I calculate an intrinsic value of $361. But if I re-run the analysis using PH’s 2024 Guidance for adjusted EPS of over $24, then I get an intrinsic value of $542.

In other words, to justify the current price, I need:

the GAAP earnings to catch up with the adjusted earnings guidance and then continue to grow at the 12% historical rate for return on invested capital, or

I need PH to bring their cost of capital down, and therefore reduce the discount factor. But with a 100% debt/equity ratio, and with PH’s stated desire to bring their overall leverage down following the Meggitt acquisition, I am not sure how likely this is (reducing debt would likely push the cost of capital up and closer to the cost of equity). Or

I need PH to start generating returns on (invested) capital beyond 12%. In fact, I think I would need to see growth in GAAP earnings of around 20% to justify the current price, starting from an EPS of $16.23

Running the above numbers through my Monte Carlo valuation model, it confirms my above assumptions - a share price in the $300s seems more reasonable than a share price in the $500s with those types of growth rates. I have to push the model pretty hard to get a share price in line with current values, in terms of both annualised growth rates (> 20%) and WACC (11% or less), which makes me uncomfortable.

So do I regret selling Parker Hannifin when I did? Fundamentally, yes. I allowed myself to be swayed by the then-recent share price moves and not the fundamentals, which were basically as strong or stronger in 2022 as they had been in 2021, when I first bought in, and there was the potential of Meggitt still to come. If anything, based on their fundamentals, I probably should have averaged down on PH in 2022. I had read enough to be worried by some of the fundamentals I was seeing, but I hadn’t been investing long enough to appreciate some of the nuance and context of what I was finding through my research (for example, a high level of debt isn’t inherently a bad thing if it remains affordable). In fact, if I’d done more research before investing, I possibly wouldn’t have bought PH in the first place, at least not without A LOT more research into Meggitt.

I’m not sure there’s much of a moral to this story, except of the importance in doing your research. I didn’t have a strong thesis to buy into Parker Hannifin and the lack of strong roots or faith in my stock pick meant it was easy for me to be knocked off-track by short-term moves in the share price. The consequence was that I basically lost the opportunity to make a return on my investment, either through the opportunity cost of leaving my money invested during a period of depressed share prices, or by selling before the uptick as Meggitt came on board and their earnings started being consolidated into PH’s earnings. I should have either not invested at all, or held firm until I saw the results of the acquisition.

But now, having sold, I think the company is relatively expensive, and I am unlikely to buy back in at current prices. The returns on capital are not bad, but they are generally not market-beating, and I do not perceive enough of a margin of safety at current prices. So PH remains on my watchlist for now.