I first published this in February 2024 on the Trading 212 app in the Value Investing community, under the username “Anathema”

5 months ago, I analysed Rolls Royce's 23H1 financials. At the time, the share price was around 220p, and I concluded that a fair value was more like 150p.

This was based on gross profit margins of around 31% (based on my particular adjustments and analyses) and net profit margins of 16%. I assumed growth of around 10% per annum with a view that revenues were unlikely to grow much beyond pre-Covid levels (£7B - £8B in Civil Aerospace), due to the drag from the 'new markets' segment and due to Weighted Average Cost of Capital (WACC) being very high, at around 19%, largely caused by the negative equity. To justify the then-current share price of 220p, I had to assume 15% - 20% growth for the next 5 years and a WACC of 8% - 10%.

Following RR's Full Year earnings, the share price is now 353p. I am up over 100% on my holding, but my holding remains small, because I wasn't willing to violate my 150p average price (I actually have a current average share price of 155p).

So how was 2023 for Rolls Royce?

For anyone who has been under a rock for the last few weeks - pretty good. So what did I get wrong?

To start with, my assumed growth rate. Civil Aerospace is now back to pre-Covid levels, at £7.3B, which is almost 30% higher than 2022. Although I foresaw that, I didn't consider strong growth in Defence revenue, which grew 11% from last year, which was already 9% higher than its 5Y average. The one I really didn't expect, though, was a 19% growth in revenues in Power Systems, a business segment Tufan had singled out for special management focus. This growth in Defence and Power Systems means Civil Aerospace is still less than half of total revenue, while pre-Covid it was slightly more than half of revenues.

The other thing I didn't expect was a substantial increase in margin in Civil Aerospace. Tufan had previously singled out onerous Long-Term Service Agreements (LTSA) as a reason for poor business performance and vowed to tackle them. To scale the management team's success here, before Covid, a 5% - 6% segment margin was reasonable, last year it was 2.5%, but in 2023 that margin shot up to 11.6%. Defence and Power Systems margins are also a bit better than last year, but roughly in the mix with historical precedent.

It's not all rosey - New Markets' losses widened 20% to -£160M on revenue of £4M, and Tufan's approach has led to a loss of some previous contracts, as well as the gain of some new contracts.

Overall, though, revenues are up 20%, gross margins have held flat vs 2022 at 28% (excluding depreciation and amortisation). However, EBIT margin is now over 10%, around 430 basis points (bps) higher than the 6.4% in 2022, while net profit margin is up 520 bps from 9.4% to 14.6%. This year, finance income and earnings from investments provided a substantial bump to the bottom line, while last year debt repayments and foreign exchange contract costs caused a heavy drag on EBIT.

EPS came in around 29p in 2023, meaning RR is moving closer to the roughly 50p seen in 2017 (adjusting for share count).

Free Cash Flow per share is now around 19p, vs 10p in 2022. At H1 in their trading update, they guided for £900M in 2023, which was around 10p/share (although my FCF calculation is more simplistic than RR's own calculation)

The large jump in EBIT this year means interest cover is now almost 5, significantly better than the 2.5 seen last year. Cost of debt is still high, almost 9% (interest payments as a proportion of total debt), increased from 6.3% in 2022, and in line with my previous valuation. Cost of Equity is high, too, due to strong 2023 market returns.

RR still has negative equity and almost £5.8B of total debt. However, it has massively improved stockholder equity since 2022.

Return on Assets is now around 8% and Return on Invested Capital is now over 16%.

In short, I didn't expect the margin increase in civil aerospace or the revenue increase in defence or power systems, and I underestimated the business profit improvements RR could make in a year.

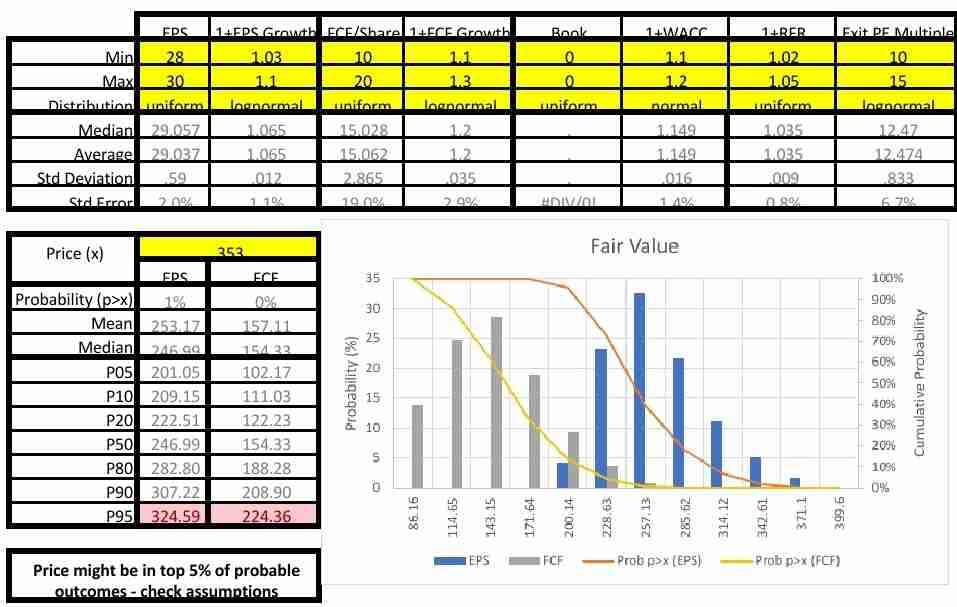

so what is a fair value now?

Well, you're probably not going to find it surprising that I am probably still going to unapologetically be conservative here!

Airbus estimate a 3.6% CAGR in air traffic over next 20 years. They anticipate around 20% of new aircraft to be the widebody aircraft typical of RR customers. However, there are areas of the world (mostly south-east Asia) expecting 6% - 11% CAGR over next 15 years (source: Grupo One Air).

RR are targeting £3B in free cash flow by 2027, and they are now already close to the operating margin they expect to maintain. Versus 19p per share, this implies FCF growth of 17% CAGR.

Last time I valued RR, I expected P/E to sit in the range 5 - 10. But with current P/E and the ROIC now being reported, P/E expansion to 10 - 15 could be justified.

With these assumptions, and allowing EPS to grow between 3% and 10%, or allowing FCF to grow 20% +/- 10%, I believe fair value could be comfortably justified at 180p - 230p. However, 300p is, in my view, top end.

I wouldn't open a position here but I might add to my existing position, up to an average of around 200p.

Interesting overview, thanks. I have also been impressed and surprised in equal measure at RR's performance in 2023. I am not a holder however. For me the negative equity and huge debt were a real barrier. Looking now, if the shares were to fall to the 200p mark, I would really consider buying, although I would need to do a lot more homework to fully convince myself that 2023 was not just a 'one off'!